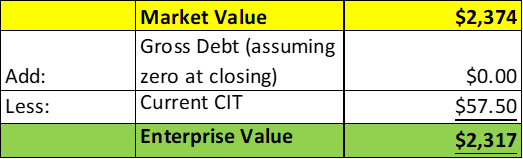

- JVSPAC Acquisition Corp. (JVSA) to merge with Hotel101 (Spin-off) in a transaction valuing the pro forma entity at *$2,317 million in Enterprise Value (*$2,374 million of pro forma equity value assuming zero redemptions).

- Hotel101 shareholders will receive aggregate equity consideration of $2.3 billion at $10.0 per share and up to 500,000 Earnout Shares if its reported consolidated revenue for fiscal year 2025 reaches at least $113.25 million, with 50% subject to no lock-up and the remaining 50% under a 6-month lock-up period from the date of issuance.

- JVSA’s total outstanding liabilities must not exceed $4.50 million, excluding deferred underwriting fees and any fees and expenses incurred in connection with negotiations.

- No minimum cash condition.

- DoubleDragon will pay $1.00 million termination fee if it terminates the agreement at its discretion or if JVSA terminates due to Target’s breaches; Termination fee will become $2.00 million if agreement is terminated by JVSA because Nasdaq approval isn’t obtained due to DoubleDragon’s Philippine Stock Exchange listing. JVSA will pay DoubleDragon a $1.00 million Reverse Termination Fee if it terminates the agreement at its discretion or if DoubleDragon terminates it due to a material breach by JVSA.

- Business combination transaction is targeted to close in the second half of 2024.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 1 Right

- #Cash in Trust: $57.5 (100% of Public Offering)

- Public Shares Outstanding: 5.75 million shares

- Private Shares Outstanding: 1,677,500 shares (including 240,000 shares contained in Private Units)

- Reported Trust Value/Share: $10.0 per share

- Current Liquidation Date: January 23, 2025

- Outside Liquidation Date: July 23, 2025

- Name of Target: Hotel101 (subsidiary of DoubleDragon (DD.PS))

- Description of Target: Hotel101 is the hotel arm of Philippines-listed DoubleDragon, formed by tycoon Edgar “Injap” Sia II with Jollibee Foods (JFC.PS), opens new tab owner Tony Tan Caktiong. Hotel101 builds and operates hotels with standardized, 21 square metre rooms that it sells individually to investors. Hotel101’s asset-light business model generates revenue first from room sales and then from the recurring income from day-to-day hotel operations.

- Announced Date: April 8, 2024

- Expected Close: “Second Half of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1866001/000121390024030987/ea020344701ex99-1_jvspac.htm

- Transaction Terms (N/A):

- Transaction Price: $10.0 per share

- Pro Forma Equity Value: *$2,374 million

- Pro Forma Enterprise Value: *$2,317 million

- Target Shareholders Receive (*96.9%):

- DoubleDragon will transfer:

- 40% of the total issued share capital of Hotel of Asia to PubCo in exchange for 30,935,563 PubCo Class A ordinary shares

- certain real estate-related properties to Hotel101 Global in exchange for the issuance of ordinary shares in Hotel101 Global to DDPC

- Closing Payment Shares: Aggregate equity consideration of $2.30 billion at $10.0 per share to DDPC, Hotel 101 Worldwide, and certain key executives of the Company Parties

- Earnout Shares: PubCo may issue up to an additional 500,000 as Earnout Shares if its reported consolidated revenue for fiscal year 2025 is at least $113.25 million (these shares serve as a bonus to directors, executives, managers, advisors, and employees of PubCo, its subsidiaries, and/or parent companies):

- 50% shares: No lock-up

- 50% shares: 6-month lock-up period from the date of issuance

- DoubleDragon will transfer:

- PIPE / Financing:

- Nil

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Lock-up:

- At closing, parties will enter into a lock-up agreement in the form and substance to be mutually agreed upon

- Closing Conditions:

- Termination date: Not provided

- No minimum cash condition

- SPAC total outstanding liabilities ≤ $4.50 million (Excluding deferred underwriting fees and any fees and expenses incurred in connection with the negotiation)

- Other customary closing conditions

- Termination:

- Termination fee of $1.00 million will be paid by DoubleDragon if the agreement is terminated:

- by DoubleDragon in its sole discretion

- by SPAC:

- if Target breaches representations, warranties, agreements, or covenants and such breach is not cured within 30 days

- if any Target party fails to prepare and deliver financial statements on time

- Termination fee of $2.00 million will be paid by DoubleDragon if the agreement is terminated:

- by SPAC if Nasdaq approval is not obtained within a specified period due to DoubleDragon’s listing on the Philippine Stock Exchange

- SPAC will pay DoubleDragon $1.00 million as the Reverse Termination Fee if the agreement is terminated:

- by SPAC in its sole discretion without any failure on Target’s part

- by DoubleDragon on any material breach by SPAC

- Termination fee of $1.00 million will be paid by DoubleDragon if the agreement is terminated:

- Advisors:

- Target Legal Advisors: Milbank (Hong Kong) LLP

- SPAC Legal Advisors: Loeb & Loeb LLP

- Target Financial Advisor: Merdeka Corporate Finance Limited

- SPAC Transaction Counsel: DaHui Lawyers

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan

- No information available

*Denotes estimated figures by CPC

#Reported as on January 23, 2024 (IPO Closing Date)