March 4, 2023

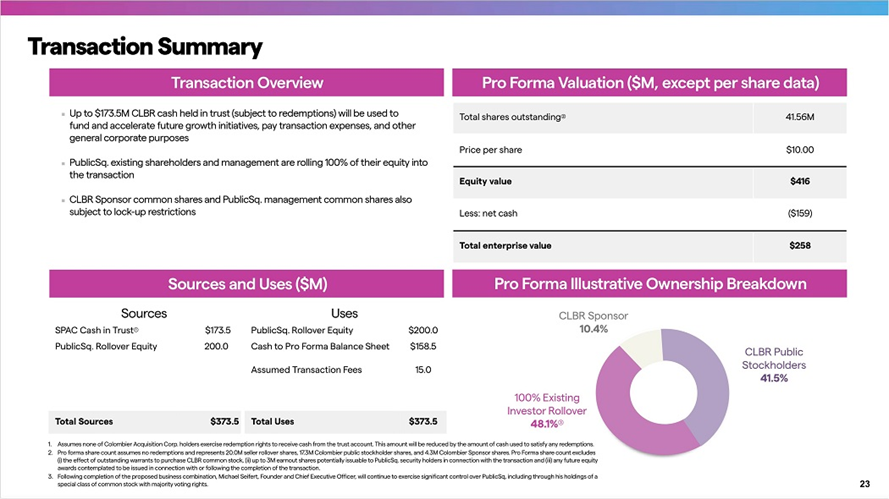

- Colombier Acquisition Corporation (CLBR) to acquire PSQ Holdings, Inc. (private) in a transaction valuing the pro forma entity at $258 million in Enterprise Value ($416 million equity value).

- PSQ shareholders will receive equity consideration of $200 million at $10.0 per share subject to adjustments along with 3.00 million earnout shares vesting in three equal tranches at a price of $12.5, $15.0, and $17.5 respectively.

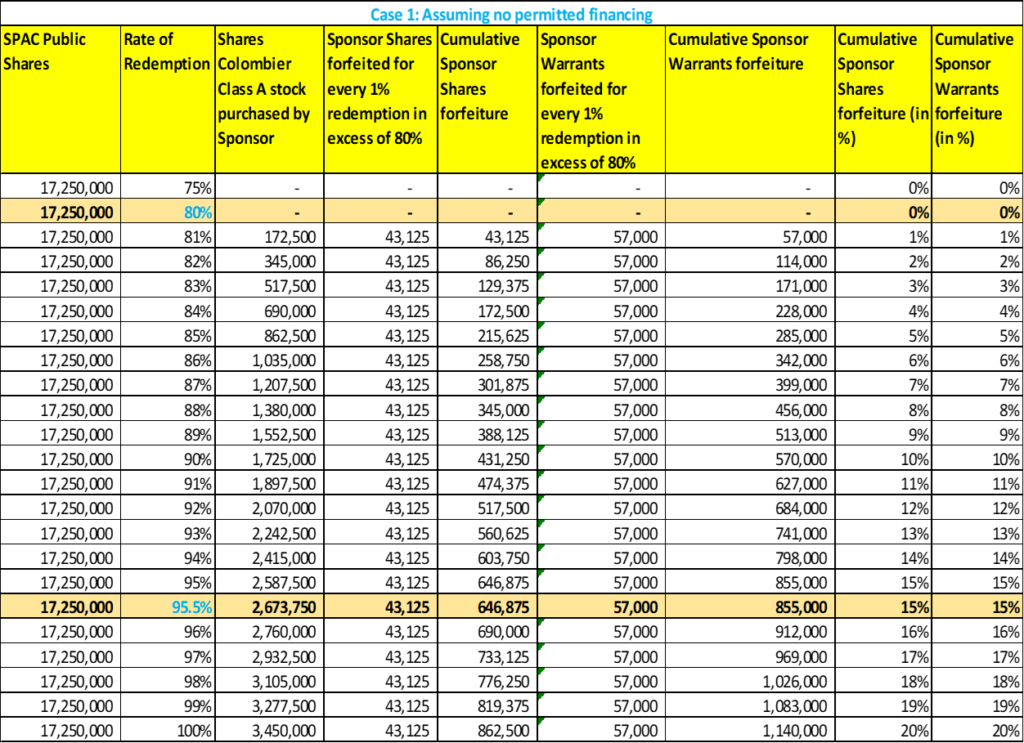

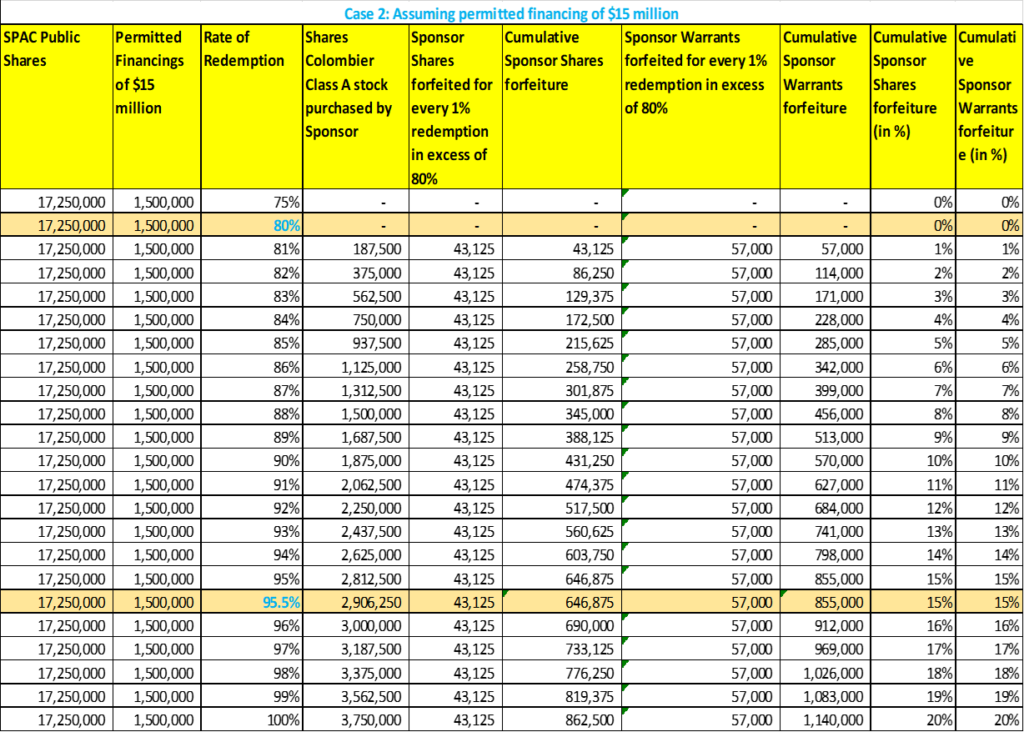

- Sponsor agreed to forfeit 1% of the Colombier Class B Common Stock and Warrants to purchase Colombier Class A Common Stock held by Sponsor for every 1% of redemptions in excess of 80% of the sum of: (a) the number of shares of Colombier Class A Common Stock issued and outstanding at closing AND (b) Aggregate proceeds raised in any Permitted Financing, divided by $10.0.

- Minimum net cash condition of $33.0 million subject to adjustments.

- The agreement includes a target termination fee equal to 50% of permitted financing proceeds (if any) obtained by PSQ payable under certain circumstances.

- Business combination transaction is targeted to close in the third quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 1/3 Redeemable Warrant

- #Cash in Trust: $173,506,965 (100.6% of Public Offering)

- Public Shares Outstanding: 17.25 million shares

- Private Shares Outstanding: 4.3125 million shares

- Reported Trust Value/Share: $10.06

- Liquidation Date: June 11, 2023

- Name of Target: PSQ Holdings, Inc

- Description of Target: PublicSq. is an app and website that connects freedom-loving Americans to high-quality businesses that share their values, both online and in their local communities. The primary mission of the platform is to help consumers “shop their values” and put purpose behind their purchases. In less than eight months since its nationwide launch, PublicSq. has seen tremendous growth and proven to the nation that the parallel, “patriotic” economy can be a major force in commerce. The platform has businesses from a variety of different industries and it is free to join for both consumers and business owners alike.

- Announced Date: February 27, 2023

- Expected Close: “Third Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1847064/000121390023014898/ea174350ex99-1_colombier.htm

- Transaction Terms (https://content.bamsec.com/0001213900-23-014898/ex99-2_023.jpg):

- Enterprise Value: $258.0 million

- Market Cap Value: $416.0 million

- Target Shareholders Receive (~48.1%):

- Equity consideration of $200 million subject to the adjustment of closing net indebtedness

- 20.0 million shares at $10.0 per share consist of:

- Shares of Colombier Class A Common Stock for PSQ shareholders other than Founder

- Shares of Colombier Class C Common Stock for PSQ Founder shareholder (Michael Seifert)

- Shares of Colombier Class C Common Stock (as a group) will be entitled to a number of votes = Aggregate Class C Voting Power = Shares of Colombier Class A Common Stock (outstanding at the time any vote is taken) + 100

- Each share of Colombier Class C Common Stock will be entitled to a number of votes = Aggregate Colombier Class C Voting Power/Shares of Colombier Class C Common Stock (outstanding as of the applicable record date)

- 20.0 million shares at $10.0 per share consist of:

- Earn-Out: 3.00 million Shares of Colombier Class A Common Stock (5 years after closing) to Merger Holders & certain other employees and service providers of PSQ:

- 1.00 million shares @ $12.5

- 1.00 million shares @ $15.0

- 1.00 million shares @ $17.5

- Equity consideration of $200 million subject to the adjustment of closing net indebtedness

- PIPE / Financing:

- None

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Sponsor agreed to forfeit 1% of the Colombier Class B Common Stock and warrants to purchase Colombier Class A Common Stock held by Sponsor for every 1% of redemptions in excess of 80% of the sum of (a) and (b) where:

- (a) the number of shares of Colombier Class A Common Stock issued and outstanding at closing

- (b) Aggregate proceeds raised in any Permitted Financing, divided by $10.0

- Lock-up:

- SPAC Sponsor and Certain Target Shareholders: 1-year post-closing

- Early Release: If the price equals or exceeds $12.0 per share after 150 days post-closing

- SPAC Sponsor and Certain Target Shareholders: 1-year post-closing

- Closing Conditions:

- Minimum Net Cash Condition: $33.0 million – Minimum of (A) $15.0 million and (B) Aggregate unpaid expenses of both parties at closing – Proceeds actually received by the Target in any Permitted Financing

- Termination date: September 11, 2023 (may extend to December 31, 2023)

- PCAOB Financials by March 9, 2023

- Failure to obtain at least $15.0 million of Permitted Financing before May 15, 2023 by the Target

- Other customary closing conditions

- Termination:

- Target Termination fee payable to SPAC:

| Termination Fee = 50% Permitted Financing (Excluding proceeds received from existing PSQ stockholders and certain other parties) | |

| Termination by Target (PSQ) | Termination by SPAC (Colombier) |

| An uncured breach of the Merger Agreement by PSQRequired PSQ stockholder approval not being obtained before the 5th Business Day following the day on which the Registration Statement is declared effective under the Securities ActPSQ being unable to obtain a Permitted Financing of at least $15.0 million by May 15, 2023 | PSQ board has changed, withdrawn, withheld, qualified or modified its recommendation that the PSQ stockholders approve the Merger Agreement and the transactions contemplated thereby |

- Other standard termination clauses

- Advisors:

- Target Legal Advisors: Wilmer Cutler Pickering Hale and Dorr LLP

- SPAC Legal Advisors: Ellenoff Grossman & Schole LLP and Eversheds Sutherland LLP

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan (Stock Incentive Plan):

- 15.0% of shares outstanding post-closing

- Including an annual increase to be added on the first day of each fiscal year, commencing on January 1, 2024 and ending on January 1, 2033, equal to the lesser of:

- (A) 1% of the outstanding shares on such date

- and

- (B) the number of shares determined by the post-closing Board

- provided that, in addition to the foregoing, a number of shares of Purchaser Class A Common Stock sufficient to issue the Earnout Equity Awards shall also be available for issuance under the Stock Incentive Plan

*Denotes estimated figures by CPC

#Reported as on September 30, 2022