February 17, 2023

- Relativity Acquisition Corporation (RACY) to merge with SVES (private) in a transaction valuing the pro forma entity at $707.25 million in Enterprise Value assuming zero redemptions (from current level of 1.07%).

- SVES shareholders will receive 63.2 million shares of Pubco Common Stock at $10.0 per share.

- No minimum cash condition.

- Business combination transaction is targeted to close in the third quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of common stock + 1 warrant

- #Cash in Trust: $1.60 million (104.4% of Public Offering)

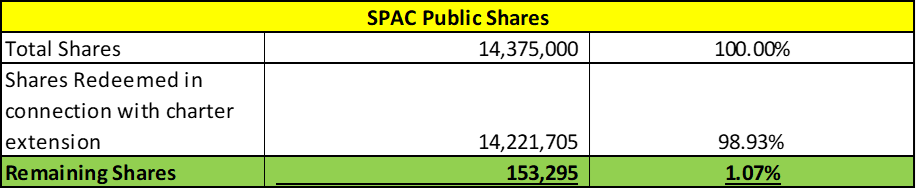

- Public Shares Outstanding: 153,295 shares

- Private Shares Outstanding: 4,247,500 shares (including 653,750 shares contained in private units)

- Estimated Trust Value/Share: $10.44

- Liquidation Date: February 15, 2023

- Current Liquidation Date: May 15, 2023

- Outside Liquidation Date: August 15, 2023

- Name of Target: SVES

- Description of Target: SVES LLC, SVES GO, LLC, SVES CP LLC and SVES Apparel LLC (collectively, “SVES”) is a leading wholesale distributor of discount and off-price fashion. SVES delivers differentiated garment and accessory assortments to major off-price retailers in North America and Europe. The SVES management team is led by off-price industry veterans, including Co-Founders Timothy J. Fullum and Salomon Murciano.

- Announced Date: February 13, 2023

- Expected Close: “Third Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1860484/000121390023010755/ea173356ex99-1_relativityacq.htm

- Transaction Terms (N/A):

- Enterprise Value: $707.25 million

- Market Value: Not provided

- SPAC Public Shareholders Receive:

- *153,295 shares of Pubco Common Stock (1 for 1)

- SPAC Sponsor Receive:

- *4,247,500 shares of Pubco Common Stock (1 for 1)

- Target Shareholders Receive:

- Equity consideration of $632 million at $10.0 per share (63.2 million shares of Pubco Common Stock)

- PIPE / Financing:

- None

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors (Insider shares & PP Shares): 6 months post-closing

- Early release: If price ≥ $12.0 after 90 days post-closing

- Key Target Shareholders: TBD

- SPAC Sponsors (Insider shares & PP Shares): 6 months post-closing

- Closing Conditions:

- Termination date: August 15, 2023 (automatic extension by 1 day for each day that such SVES financial statements have not been delivered after April 7, 2023)

- Audited SVES financial statements by April 7, 2023

- Completion of Lock-Up Agreements and Non-Competition Agreements

- No minimum cash condition

- Other customary closing conditions

- Termination:

- No termination fee

- Other Standard termination clauses

- Advisors:

- SPAC Financial Advisors: Alliance Global Partners

- Target Legal Advisors: McCarter & English

- SPAC Legal Advisors: Ellenoff Grossman & Schole

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan

- No information provided

*Denotes estimated figures by CPC

#Estimated as on December 28, 2022 (Filing of extension meeting results)