December 15, 2022

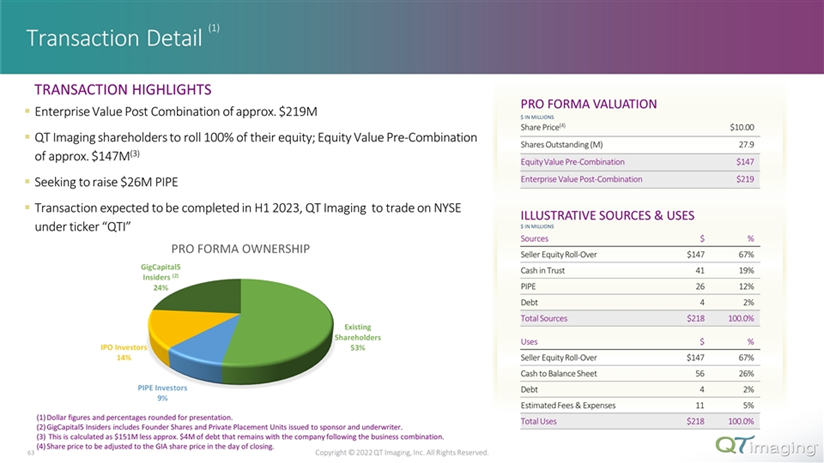

- GigCapital5, Inc. (GIA) to acquire QT Imaging (private) in a transaction valuing the pro forma entity at $219.0 million in Enterprise Value (*$277.4 million equity value assuming a PIPE raise of $26.0 million and zero redemptions from current level of 17.45% in public shares).

- QT Imaging shareholders will receive equity consideration of $147.0 million at $10.0 per share subject to adjustment along with 9.00 million earnout shares on achievement of certain performance milestones.

- GigCapital5 will seek to raise up to $26.0 million in PIPE.

- Minimum net cash condition of $15.0 million.

- Business combination transaction is targeted to close in the first half of 2023.

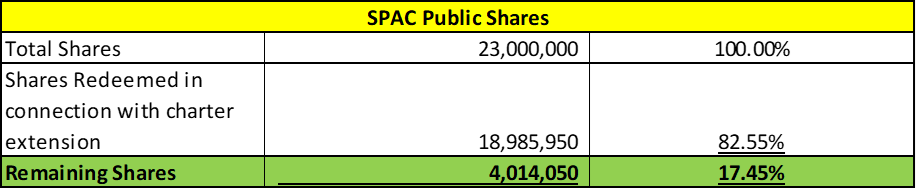

- SPAC Details:

- Unit Structure: 1 share of our common stock + 1 redeemable warrant

- #Cash in Trust: $40,487,648 (100.9% of Public Offering)

- Public Shares Outstanding: 4,014,050 shares

- Private Shares Outstanding: 6,530,000 shares (including 795,000 private shares contained in private units)

- Reported Trust Value/Share: $10.09

- Liquidation Date: September 28, 2022

- Current Liquidation Date: March 28, 2023 (extension approved on September 23, 2022)

- Name of Target: QT Imaging

- Description of Target: QT Imaging™ is engaged in the research, development, and commercialization of an innovative automated imaging system producing high-resolution transmission ultrasound images. QT Imaging has received FDA 510(K) clearance for its QT Imaging Breast Scanner. QT Imaging’s clinical trials have been conducted at prestigious institutions in the US and Europe, and the National Institutes of Health (NIH) has supported the development of the technology with over $15mm in grants. The QT Imaging Breast Scanner is indicated for use as an ultrasonic imaging system to provide reflection-mode and transmission-mode images of a patient’s breast. The QT scanner software also calculates the breast fibroglandular volume and total breast volume. The device is not intended to be used as a replacement for screening mammography. (FDA 510k K162372 and K220933). “QT Imaging” and “QTscan” are trademarks of QT Imaging, Inc.

- Announced Date: December 12, 2022

- Expected Close: “First Half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1844505/000119312522302292/d376793dex991.htm

- Transaction Terms (https://content.bamsec.com/0001193125-22-302292/g376793ex99_2s63g1.jpg):

- Enterprise Value: $219.0 million

- Market Cap Value: *$277.4 million (Pre-Money Equity Value/Target Ownership in combined company OR $147 million/53%)

- Target Shareholders Receive (~53%):

- Equity consideration of ~$147 million (shares of GigCapital5 Common stock) subject to the following adjustments:

| $151 million | |

| Add: | Sum of all the exercise prices of all in the money Target warrants |

| Add: | Target closing cash |

| Add: | Paid Target transaction expenses (paid by Target before closing) |

| Less: | Closing Debt of Target after conversion not exceeding $4.00 million |

| Less: | Aggregate transaction expenses in excess of $4.00 million |

- Earn-Out: 9.0 million shares of GigCapital5 Common Stock:

- 2023 Earnout Shares of 2.50 million shares if:

- By the filing date (2023 Form 10-K Filing Date) QT Imaging or QTI Holdings has obtained a formal FDA clearance for breast cancer screening with respect to its breast scanning systems, which remains in full force and effect as of such filing date

- 2023 Earnout Shares will increase by 0.50 million (to an aggregate of 3.00 million) if, in addition, during calendar year 2023, QT Imaging, prior to the closing, and QTI Holdings, following the closing, either:

- makes at least 8 bona fide placements of its breast scanning systems globally

- OR

- achieves annual revenue of at least $4.40 million as set forth in the financial statements included in the 2023 Form 10-K

- 2023 Earnout Shares will increase by 0.50 million (to an aggregate of 3.00 million) if, in addition, during calendar year 2023, QT Imaging, prior to the closing, and QTI Holdings, following the closing, either:

- By the filing date (2023 Form 10-K Filing Date) QT Imaging or QTI Holdings has obtained a formal FDA clearance for breast cancer screening with respect to its breast scanning systems, which remains in full force and effect as of such filing date

- 2024 Earnout Shares of 2.50 million shares if:

- QTI Holdings achieves annual revenue of at least $17.10 million as set forth in the financial statements included in the 2024 Form 10-K

- AND

- QTI Holdings makes at least 4 placements of its breast scanning systems in the United States

- 2024 Earnout Shares will increase by 0.50 million (to an aggregate of 3.00 million) if at least one of the following milestones is achieved:

- on or prior to such filing date, QTI Holdings has obtained a formal FDA clearance for a new indication for use of its breast scanning systems (other than any indication obtained prior to calendar year 2024), which remains in full force and effect as of such filing date

- OR

- QTI Holdings achieves clinical-quality patient images with QTI Holdings’ open angle scanner during the 2024 calendar year, as reported in the 2024 Form 10 K

- 2024 Earnout Shares will increase by 0.50 million (to an aggregate of 3.00 million) if at least one of the following milestones is achieved:

- 2025 Earnout Shares of 2.50 million shares if:

- promptly following the filing date (2025 Form 10-K filing date) if, and only if, during calendar year 2025:

- QTI Holdings achieves annual revenue of at least $67 million as set forth in the financial statements included in the 2025 Form 10-K

- OR

- VWAP of shares of GigCapital5 Common Stock equals or exceeds $15.0 per share provided, that the 2025 Earnout Shares will increase by 0.50 million (to an aggregate of 3.00 million) if at least one of the following milestones is achieved on or prior to such filing date: QTI Holdings has obtained a formal FDA clearance of its open angle scanner, which remains in full force and effect as of such filing date

- OR

- QTI Holdings receives net positive results in bona fide clinical trials, conducted in accordance with generally accepted industry standards, for its open angle scanner, as reported in the 2025 Form 10-K

- promptly following the filing date (2025 Form 10-K filing date) if, and only if, during calendar year 2025:

- 2023 Earnout Shares of 2.50 million shares if:

- PIPE / Financing (~9%):

- GigCapital5 expects to raise up to $26.0 million in PIPE (GigCapital5 Common Stock, convertible promissory notes or other securities or any combination of such securities)

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors (Insider shares & PP Shares) and Target shareholders: 6 months post-closing

- Early Release: If price ≥ $11.5 per share after 90 days post-closing

- SPAC Sponsors (Insider shares & PP Shares) and Target shareholders: 6 months post-closing

- Closing Conditions:

- Minimum Net Cash Condition: $15.0 Million

- Termination date: September 8, 2023

- Target closing debt ≤ $4.00 million

- Other customary closing conditions

- Termination:

- No termination fees

- Standard termination clauses

- Advisors:

- Target Legal Advisors: Seyfarth Shaw LLP

- SPAC Legal Advisors: DLA Piper LLP (US)

- Financial and Capital Markets Advisors: Northland Securities, Inc.

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan

- Initial equity pool of 11.0% of fully diluted shares outstanding post-closing

- Includes an evergreen provision:

- automatic increase on each January 1st that occurs within the 10-year period following stockholder approval of such plan by an amount equal to 5% percent of the shares of GigCapital5 Common Stock outstanding on such date

- Up to 25% of the Initial Equity Plan Pool would be reserved for issuance to individuals who were employees or other service providers of QT Imaging as of the closing and remain continuously employed or engaged by QTI Holdings at the time of the issuance of such awards post-closing

*Denotes estimated figures by CPC

#Reported as on September 30, 2022