March 23, 2023

- Home Plate Acquisition Corp. (HPLT) to merge with Heidmar (Private) in a transaction valuing the pro forma entity at $214.4 million in Enterprise Value ($261.4 million equity value) assuming 95% redemptions.

- Heidmar shareholders will receive an equity consideration of $160.0 million at $10.0 per share.

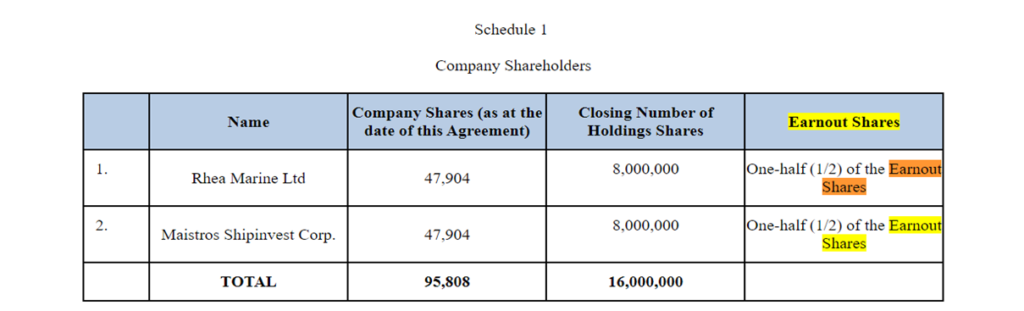

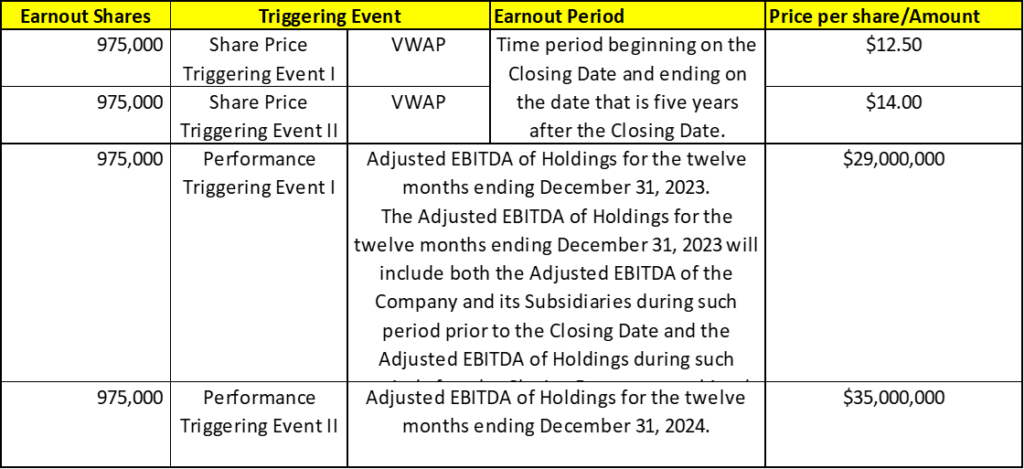

- Transaction includes up to 3.90 million Earnout Shares to eligible Heidmar Shareholders subject to certain triggering events (5 years after closing).

- HPLT is expected to raise $45.0 million of Common Stock PIPE at $10.0 per share.

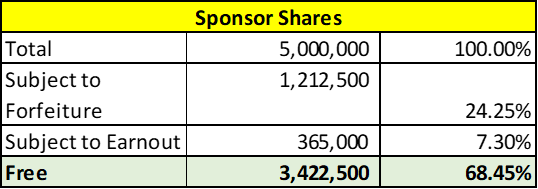

- Sponsor has agreed to forfeit the right to receive 1,212,500 Holdings common shares (or *24.25%) and Holdings warrants in an amount equal to $5.00 per Holdings warrant to the extent that the transaction expenses of Home Plate exceed $15.0 million and, in each case, such forfeited Holdings common shares and Holding warrants will be issued to the Heidmar Shareholders.

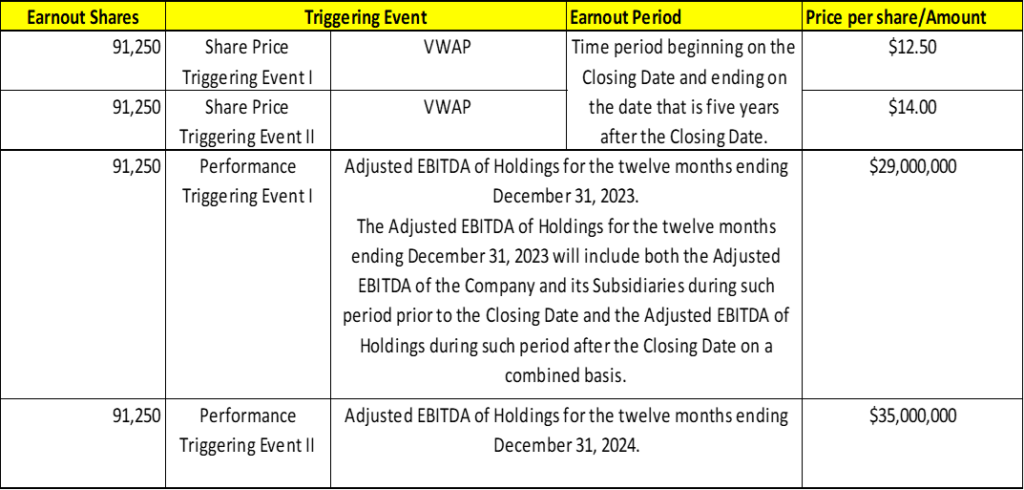

- In addition, Sponsor agreed to subject 365,000 Holdings Common Shares (or *7.30%) to be received in earn-out (5 years after closing).

- Minimum net cash condition of $40.0 million.

- No termination fees.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 0.50 Redeemable Warrant

- #Cash in Trust: $202,945,447 (101.4 % of Public Offering)

- Public Shares Outstanding: 20.0 million shares

- Private Shares Outstanding: 5.0 million shares

- Reported Trust Value/Share: $10.14

- Liquidation Date: April 4, 2023 (Definitive proxy filed on 3/13/2023 to extend the deadline to October 4, 2023)

- Name of Target: Heidmar

- Target Description: Heidmar is an Athens based, first-class commercial and pool management business servicing the crude and product tanker market and is committed to safety, performance, relationships and transparency. Heidmar has a reputation as a reliable and responsible partner with a goal to maximizing our customer’s profitability. Heidmar seeks to offer vessel owners a “one stop” solution for all maritime services in the crude oil, refined petroleum products and dry bulk shipping sectors. Heidmar believes its unique asset light business model and extensive experience in the maritime industry allows the Company to achieve premier market coverage and utilization, as well as providing customers in the sector with seamless commercial transportation services.

- Announced Date: March 20, 2023

- Expected Close: No information provided

- Press Release: https://www.sec.gov/Archives/edgar/data/1863181/000114036123012443/ny20008306x2_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1863181/000114036123012443/ny20008306x2_ex99-3slide7.jpg):

| Redemption Rate (assuming maximum redemptions) | 95% |

| Share Price | $10.00 per share |

| Enterprise Value | $214.4 million |

| Market Cap Value | $261.4 million |

- SPAC Public Shareholders Receive:

- *1.0 million Holdings common shares (1 for 1)

- SPAC Sponsors Receive:

- *3,422,500 Holdings common shares (1 for 1)

- Target Shareholders Receive (~65%):

- Equity consideration of $160 million at $10.0 per share (16.0 million Holdings common Shares)

- Earnout Consideration of up to 3.90 million shares (15% of 26.1 million shares):

- PIPE / Financing (~17%):

- $45.0 million of Common Stock PIPE at $10.0 per share

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- Sponsor agreed to forfeit 1,212,500 Holdings Common Shares (or *24.25%) for no consideration

- If SPAC Transaction Expenses exceed $15 million then,

- Sponsor shall forfeit the right to receive Holdings Private Warrants equal to:

- (SPAC Transaction Expenses – $15 million)/ $5.00

- Note: Forfeited sponsor shares and warrants will be issued to Target shareholders

- Sponsor agreed to subject 365,000 Holdings Common Shares to be received to earn-out conditions subject to release as follows:

- If there is a change in control:

- Following the Closing Date but before December 31, 2023:

- 182,500 shares shall vest together with any Sponsor Earnout Shares that vest pursuant share price triggers

- Following December 31, 2023 but before December 31, 2024:

- 91,250 shares shall vest together with any Sponsor Earnout Shares that vest pursuant to share price triggers

- During the Share Price Earnout Period and pursuant to which Holdings or its shareholders shall receive consideration implying a value per Holdings Common Share of:

- less than $12.50

- Zero Shares shall vest

- greater than or equal to $12.50 but less than $14.00

- 91,250 shares (less any Sponsor Earnout Shares issued before such Change of Control together with any Sponsor Earnout Shares that vest pursuant to performance triggers above

- greater than or equal to $14.00

- 182,500 shares (less any Sponsor Earnout Shares issued before such Change of Control together with any Sponsor Earnout Shares that vest pursuant to performance triggers above

- less than $12.50

- Following the Closing Date but before December 31, 2023:

- Lock-up:

- SPAC Sponsors and Key Target Shareholders: 150 days post-closing

- Closing Conditions:

- Termination date: April 4, 2023 (October 4, 2023 with extension)

- Minimum net cash condition of $40 million

- Cash includes:

| Cash in Trust | |

| Less: | Redemptions |

| Add: | Actual PIPE Proceeds |

| Less: | SPAC Transaction Expenses |

- Other customary closing conditions

- Termination:

- Termination by Target:

- on May 30, 2023 (or within next 3 Business days)

- if prior to such date, Target & SPAC have conducted marketing efforts with potential PIPE Investors, and following such efforts Target determines, in its reasonable discretion, that Parties will not be able to consummate a PIPE Investment on terms reasonably satisfactory to Target prior to April 4, 2023

- on May 30, 2023 (or within next 3 Business days)

- No termination fees

- Other standard termination clauses

- Termination by Target:

- Advisors:

- SPAC Capital Market Advisor: Jefferies

- Target Financial Advisor: Seaborne Capital Advisors

- SPAC Legal Advisors: Latham & Watkins LLP

- Target Legal Advisors: Seward & Kissel LLP

- Placement Agent: Paul Hastings LLP

- SPAC Special Advisor: ClearThink

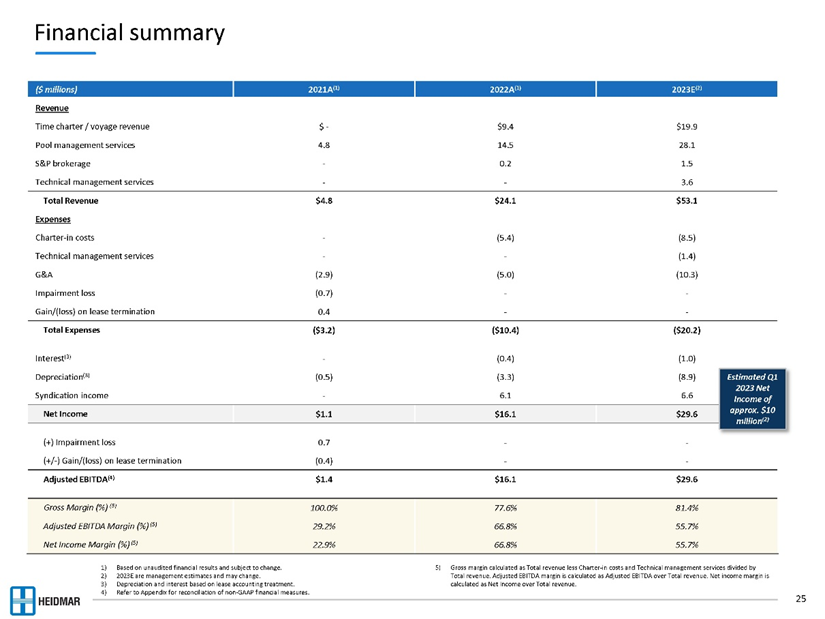

- Financials (https://www.sec.gov/Archives/edgar/data/1863181/000114036123012443/ny20008306x2_ex99-3slide25.jpg):

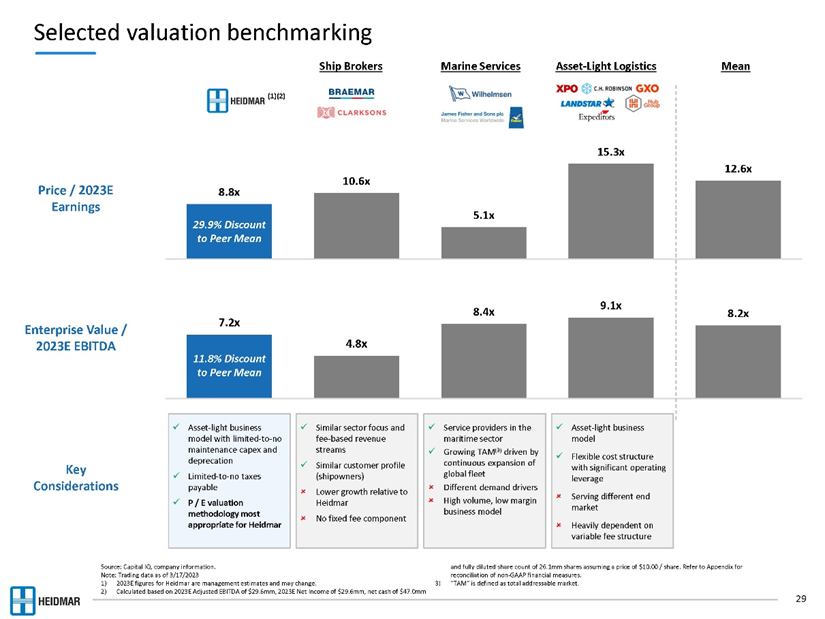

- Comparables (https://www.sec.gov/Archives/edgar/data/1863181/000114036123012443/ny20008306x2_ex99-3slide29.jpg):

- Equity Incentive Plan:

- Share reserve equal to 15% of Holdings common stock post-closing

*Denotes estimated figures by CPC

#Reported as on December 31, 2022