January 17, 2023

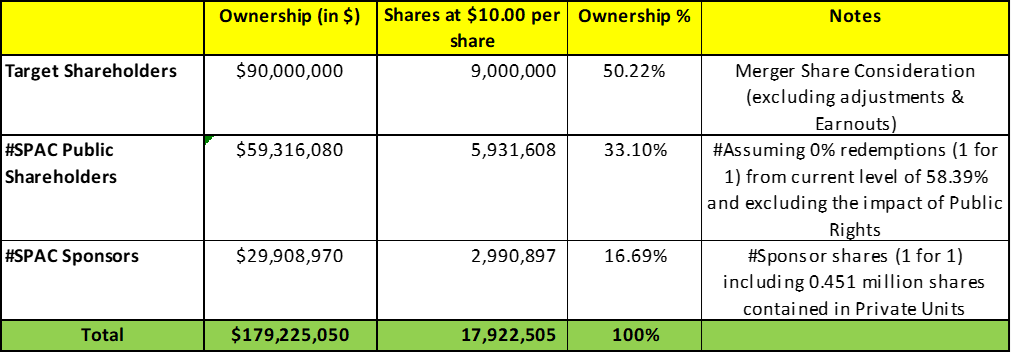

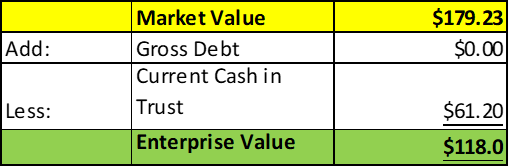

- Broad Capital Acquisition Corporation (BRAC) to merge with Openmarkets (private) in a transaction valuing the pro forma entity at *$118 million in Enterprise Value (*$179 million equity value) assuming zero redemptions from current level of 58.39% in public shares.

- Openmarkets shareholders will receive equity consideration of $90.0 at $10.0 per share along with 2.00 million earnout shares.

- Closing Company (Openmarkets) Cash condition of A$7.00 million.

- Agreement includes a Break-up fee of $5.00 million payable by Openmarkets to BRAC if agreement is terminated by either party due to an Alternative Proposal or breach by Openmarkets of its representations & warranties. Further, Openmarkets will reimburse BRAC’s expenses if the agreement is terminated by BRAC due to Openmarket’s failure to deliver Audited 2021/2022 Financial statements by February 19, 2023.

- Business combination transaction is targeted to close in the second quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of common stock + 1 right (to receive 1/10 of common stocks)

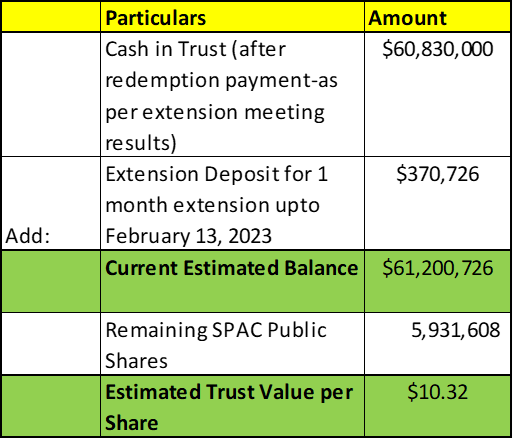

- #Cash in Trust: $61,200,726 (103.2% of Public Offering)

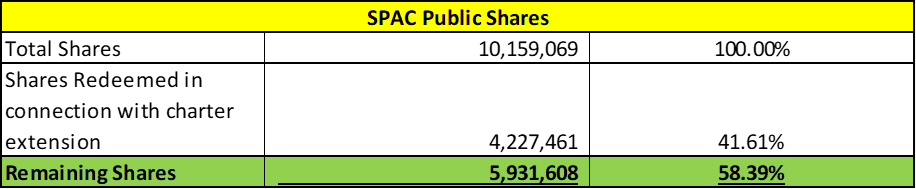

- Public Shares Outstanding: 5,931,608 shares

- Private Shares Outstanding: 2,990,897 shares (including Private shares contained in 451,130 Private units)

- Estimated Trust Value/Share: *$10.32

- Liquidation Date: January 13, 2023

- Current Liquidation Date: February 13, 2023

- Outside Liquidation Date: October 13, 2023

- Name of Target: Openmarkets

- Description of Target: Openmarkets Group (“OMG”) (www.openmarkets.group) is the parent company of “Openmarkets” (www.openmarkets.com.au), a group of market leading API-led market infrastructure fintech companies that provides a suite of technologies as well as access to Australian and international equities markets to B2B clients, including fintechs, trading platforms and investment professionals. Openmarkets’ products and services include wholesale execution, clearing and settlement for Australian equity securities, a white-label order management system, an options risk management system, smart portfolio rebalancing technology, access to live data, news, reports and other API services, as well as exposure to equity capital markets transactions.

- Announced Date: January 19, 2023

- Expected Close: “Second Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1865120/000149315223001828/ex99-1.htm

- Transaction Terms (N/A):

- Market Cap: *$179 million

- Enterprise Value: *$118 million

- SPAC Public Shareholders Receive:

- *5,931,608 Purchaser Shares (1 for 1)

- SPAC Sponsor Receive:

- *2,990,897 Purchaser Shares including 451,130 private shares (1 for 1)

- Target Shareholders Receive (~*50.22%):

- Equity consideration of $90.0 million (9.00 million Purchaser Shares at $10.0 per share) subject to adjustment based on net indebtedness, working capital, and indemnification obligations

- Earn-Out: 2.0 million shares of common stock (2 years after closing)

- ½ * 2.0 million * (Measured Performance Level – Earnout Threshold) / (Target Performance Level – Earnout Threshold)

- Notes:

- a single Earnout Payment cannot exceeed 1.00 million Purchaser Shares

- total Earnout Payments cannot exceed 2.00 million Purchaser Shares

- PIPE / Financing:

- None

- Redemption Protections:

- None

- Support Agreement:

- None

- Lock-up:

- SPAC Sponsors: 12 months post-closing

- Target Shareholders: 12 months post-closing

- Target Earnout Participants: 24 months post-closing

- Closing Conditions:

- Closing Company (Openmarkets) Cash: A$7.00 million

- Cash & Cash Equivalents – Aggregate amount of outstanding and unpaid checks

- Approved by Australian Foreign Acquisitions and Takeovers Act 1975 (Cth)

- Termination date: June 30, 2023

- Audited 2021/2022 Financial Statements by February 19, 2023

- Other customary closing conditions

- Closing Company (Openmarkets) Cash: A$7.00 million

- Termination:

- Break-up Fee of $5.00 million by Target to SPAC (plus SPAC’s reasonable and documented out-of-pocket expenses) if agreement is terminated by either party due to:

- Non-Approval of Extension proposal

- Other standard termination clauses

- Advisors:

- Target Financial Advisors: ARC Group Limited

- Target Legal Advisors: Biztech Lawyers

- SPAC Legal Advisors: Nelson Mullins Riley & Scarborough LLP

- Target Auditors: MSPC Certified Public Accountants and Advisors and Moore Australia

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan

- 5% of fully-diluted shares outstanding post-closing

- Award of 200,000 Purchaser Shares to the CEO and General Counsel post-closing

- Award of 50,000 Purchaser Shares to the staffs post-closing

*Denotes estimated figures by CPC

#Estimated as on January 17, 2023 (Extension Meeting Results)