- Clover Leaf Capital Corp (CLOE) to acquire Kustom Entertainment (Private) in a transaction valuing the pro forma entity at *$204 million in Enterprise Value ($222 million equity value) assuming zero redemptions from the current level of 88.2%.

- Kustom Entertainment shareholders will receive an equity consideration of $125 million at $11.14 per share.

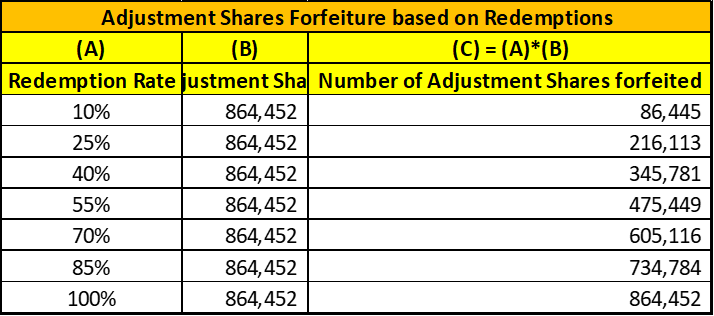

- The sponsor has agreed to forfeit 864,452 sponsor shares (or *25%). Additionally, the sponsor has also agreed to subject an additional 864,452 sponsor shares (or *25%) to earnout out of which 518,672 or (15%) will be given to the CEO Stanton E. Ross as earnout. The earnout shares will be given based on revenue threshold.

- Target will pay $1.75 million plus all expenses incurred by SPAC as termination fee if the target terminates the Merger Agreement revoking its decision of transaction approval.

- Business combination transaction is targeted to close in 2023.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 1 Right

- #Cash in Trust: $ 18,475,881 (113.5 % of Public Offering)

- Public Shares Outstanding: 1,627,158 shares

- Private Shares Outstanding: 4,271,712 shares (including 675,593 private shares contained in Private Units and 138,312 representative shares)

- Trust Value/Share: $11.35

- Current Liquidation Date: July 22, 2023

- Outside Liquidation Date: July 22, 2023

- Name of Target: Kustom Entertainment

- Target Description: Kustom Entertainment, Inc., a recently formed wholly-owned subsidiary of Digital Ally, will provide oversight to currently wholly-owned subsidiaries TicketSmarter and Kustom 440. TicketSmarter offers tickets to more than 125,000 live events ranging from concerts to sports and theatre shows. TicketSmarter is the official ticket resale partner of over 35 collegiate conferences, over 300 universities, and hundreds of events and venues nationally. TicketSmarter is a primary and secondary ticketing solution for events and high-profile venues across North America. Established in late 2022, Kustom 440 is an entertainment division of Kustom Entertainment, Inc., whose mission it is to attract, manage and promote concerts, sports and private events. Kustom 440 is unique in that it brings a primary and secondary ticketing platform, in addition to its well-established relationships with artists, venues, and municipalities

- Announced Date: June 02, 2023

- Expected Close: No information provided

- Press Release https://www.sec.gov/Archives/edgar/data/1849058/000121390023045419/ea179682ex99-1_clover.htm

- Transaction Terms (N/A):

| Redemption Rate | 0% from current level of 88.2% |

| Share Price | $11.14 per share |

| Enterprise Value | *$204 million ($222 million – $18.48 million) |

| Market Cap Value | $222 million |

- Target Shareholders Receive (~*56.3%):

- Equity consideration of $125 million at $11.14 per share (11.2 million shares of Purchaser Class A Common Stock)

- Excluding the impact of closing indebtedness

- based solely on estimates determined shortly before closing and not subject to any post-Closing true-up or adjustment

- Excluding the impact of closing indebtedness

- Equity consideration of $125 million at $11.14 per share (11.2 million shares of Purchaser Class A Common Stock)

- PIPE / Financing:

- SPAC may raise PIPE Investments up to $10.0 million

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- The sponsor has agreed to:

- forfeit up to 864,452 sponsor shares (or *25%)

- subject an additional 864,452 sponsor shares (or *25%) to forfeiture and receive them as earnout out of which 518,672 will be given to the CEO Stanton E. Ross. The earnout shares will be given based on:

- 432,226 shares (or *50%) will be vested if FY23 revenue > $24.0 million

- Sponsor: 172,890 shares

- CEO: 259,336 shares

- 432,226 shares (or *50%) will be vested if FY24 revenue > $32.5 million

- Sponsor: 172,890 shares

- CEO: 259,336 shares

- 432,226 shares (or *50%) will be vested if FY23 revenue > $24.0 million

- Lock-up:

- SPAC Sponsor: 6 months post-closing

- Early release: If price ≥ $12.0 after closing

- Target Key shareholder: 85% of shares will be subject to a lock-up period of 6 months post-closing

- Early release: If price ≥ $12.0 after closing

- Closing Conditions:

- Termination date: July 22, 2023 (January 22, 2024, if extended)

- No minimum cash condition

- Audited Financials by June 30, 2023

- Target’s audited financial statements in the fiscal year ending December 31, 2022 should not be more than 5% lower than the Target’s unaudited financial statements

- Other customary closing conditions

- Termination:

- Target will pay $1.75 million plus all expenses incurred by SPAC if the target terminates the Merger Agreement revoking its decision of transaction approval.

- Other standard termination clauses

- Advisors:

- SPAC Legal Advisors: Ellenoff Grossman & Schole LLP

- Target Legal Advisors: Sullivan & Worcester LLP

- Target Capital Market Advisors: Maxim Group LLC

- Comparable:

- No information provided

- Financials:

- No information provided

- Equity Incentive Plan:

- No information Provided

*Denotes estimated figures by CPC

#Reported as on 31st March 2023