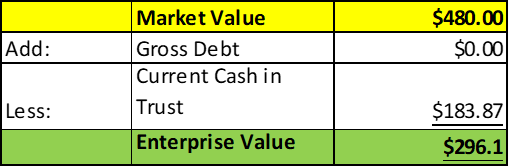

- AP Acquisition Corp (APCA) to merge with JEPLAN (Private) in a transaction valuing the pro forma entity at *$293 million in Enterprise Value ($480 million equity value) assuming zero redemptions.

- APCA public shareholders will receive *17.25 million PubCo American Depositary Shares (ADS) and *8.625 million PubCo Series 1 Warrants (on a one-for-one basis).

- Sponsors will receive *4.31 million PubCo ADS and *10.63 million PubCo Series 2 Warrants (on a one-for-one basis).

- JEPLAN shareholders will receive an equity consideration of $300 million at $10.0 per share.

- Minimum net cash condition of $30.0 million.

- No termination fees.

- Business combination transaction is targeted to close in the third or fourth quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.50 Redeemable Warran

- Public Shares Outstanding: 17,250,000 shares

- Private Shares Outstanding: 4,312,500 shares

- Estimated Trust Value/Share: $10.66

- Current Liquidation Date: September 21, 2023

- Outside Liquidation Date: December 21, 2023

- Name of Target: JEPLAN

- Target Description: JEPLAN utilizes its commercialized proprietary polyethylene terephthalate (“PET”) chemical recycling technology to produce recycled PET (“r-PET”) resin and Bis(2-Hydroxyethyl) terephthalate (“r-BHET”) resin from waste food packaging, plastic PET bottles, and waste polyester fiber, which can then be used for the manufacture and distribution of r-PET products, including PET bottles, textiles, and other plastic-based materials and products. JEPLAN’s aim is to realize a “circular economy” in which waste products are collected, recycled, and distributed back into the market for continued use. According to a 2019 Life Cycle Assessment survey by Japan’s Ministry of the Environment, the production of r-PET products from chemical recycling may achieve a 45% reduction in greenhouse gases compared to the production of virgin PET products.

- Announced Date: June 16, 2023

- Expected Close: “Third or fourth quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1862993/000110465923071887/tm2318720d1_ex99-1.htm

- Transaction Terms:

| Redemption Rate | 0% |

| Share Price | $10.0 per share |

| Enterprise Value | *$296 million |

| Market Cap Value | $480 million |

- SPAC Public Shareholders Receive:

- *17.25 million PubCo ADS (1 for 1)

- *8.625 million PubCo Series 1 Warrant (1 for 1)

- SPAC Sponsors Receive:

- *4,312,500 PubCo ADS (1 for 1)

- *10.625 million PubCo Series 2 Warrant (1 for 1)

- Target Shareholders Receive (~62.5%):

- Equity consideration of $300 million at $10.0 per share (30.0 million PubCo shares)

- PIPE / Financing:

- Parties will use their commercially reasonable efforts to raise PIPE by issuing PubCo Shares or PubCo ADSs at $10.0

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors:

- PubCo Shares: 1-year post-closing

- Early Release: If the price equals or exceeds $12.00 per share after 150 days post-closing

- PubCo Warrants: 30 days post-closing

- PubCo Shares: 1-year post-closing

- Key Target Shareholders:

- PubCo Shares: 1-year post-closing

- Early Release: If the price equals or exceeds $12.00 per share after 150 days post-closing

- PubCo Shares: 1-year post-closing

- SPAC Sponsors:

- Closing Conditions:

- Termination date: Not Provided

- Minimum net cash condition of $30.0 million

- Cash includes:

| Cash in Trust | |

| Less: | Redemptions |

| Less: | SPAC Transaction expenses |

| Less: | Target Transaction expenses |

| Add: | Permitted Equity Financing Proceeds |

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clauses

- Advisors:

- SPAC International Legal Advisor: Kirkland & Ellis

- Target US Legal Advisor: Greenberg Traurig, LLP

- SPAC Japanese Legal counsel Advisor: Mori, Hamada & Matsumoto

- Target Japanese Legal Advisor: Greenberg Traurig Tokyo Law Offices

- SPAC Cayman Legal Advisor: Maples and Calder (Cayman) LLP

- Financials:

- No financials provided

- Comparables

- No valuations provided

- Equity Incentive Plan

- No information provided

*Denotes estimated figures by CPC

#Estimated as on Jun 21, 2023 (Date of depositing extension funds to extend to September 3, 2023)