- Insight Acquisition Corp. (INAQ) to acquire Alpha Modus (Private) in a transaction valuing the pro forma entity at $175 million in Enterprise Value (*$157 million equity value) assuming zero redemption from current level of 90.3%.

- Alpha Modus shareholders will receive an equity consideration of $110 million at $10.0 per share. They are also eligible to receive 2.2 million earnout shares in three equal tranches at $13.0, $15.0, and $18.0 per share respectively over a period of 5 years post-closing.

- Sponsor agreed to subject 750,000 founder shares (or *12.5%) to earnouts provisions (vesting conditions similar to company earnouts).

- No minimum cash condition.

- No termination fees.

- Business combination transaction is targeted to close in the first quarter of 2024.

- SPAC Details:

- Unit Structure: 1 share of Class A Common Stock + 0.5 Redeemable Warrant

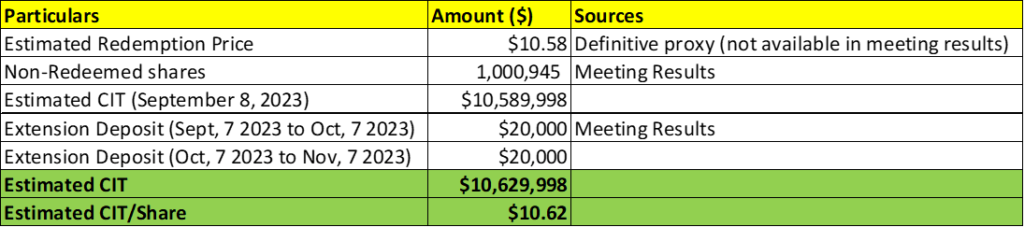

- #Cash in Trust: *$10,629,998 (106.2 % of Public Offering)

- Public Shares Outstanding: 1,000,945 shares

- Private Shares Outstanding: 6,000,000 shares

- Estimated Trust Value/Share: $10.62

- Current Liquidation Date: November 7, 2023

- Outside Liquidation Date: June 7, 2024

- Name of Target: Alpha Modus Corp

- Target Description: Alpha Modus Corp. offers technology as a service. Its core technologies have been deployed on IBM’s Bluemix platform and earned a Beacon Award by IBM 2016 for Best New Application on IBM Cloud from an Entrepreneur. Alpha Modus has been recognized by IBM Watson as a thought leader in technology

- Announced Date: October 16, 2023

- Expected Close: “First Quarter of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1862463/000101376223004184/ea186792ex99-1_insightacq.htm

- Transaction Terms (N/A):

| Redemption Rate | 0% from current level of 90.3% |

| Share Price | $10.0 |

| Enterprise Value | 175 million |

| Market Cap Value | *$157 million ($110M/70%) |

- Target Shareholders Receive (~70%):

- Equity consideration of $110 million (Shares of IAC Class A Common Stock at $10.0)

- 2.20 million earnout shares (after 180 days but before 5 years post-closing) vesting in the following manner:

- 733,334 shares @ $13.00 per share

- 733,333 shares @ $15.00 per share

- 733,333 shares @ $18.00 per share

- PIPE / Financing:

- Nil

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- Sponsor agreed to subject 750,000 shares (or *12.5%) to earnout provisions (after 180 days but before 5 years post-closing) vesting in following manner:

- 250,000 shares @ $13.00 per share

- 250,000 shares @ $15.00 per share

- 250,000 shares @ $18.00 per share

- Lock-up:

- SPAC Sponsor (^85% shares): 12 months post-closing

- Early release: If price ≥ $12.5 per share

- ^Note: 85% of sponsor shares excluding the sponsor earnout shares (or *4,462,500 shares)

- Early release: If price ≥ $12.5 per share

- Key Target Shareholder: 12 months post-closing

- Early release: If price ≥ $12.5 except for certain shares which is equal to:

- SPAC Sponsor (^85% shares): 12 months post-closing

| 1,650,000 shares | |

| Add: | Number of Common Shares issued to JanBella Group, LLC |

| Less: | 557,692 which may be sold by the Alpha Modus Lock-Up |

- Closing Conditions:

- Termination date: June 7, 2024

- No minimum cash condition

- Dissenting shares ≤ 5%

- Deliver:

- Audited Financial Statements within dates specified (not mentioned)

- Unaudited Interim Financial Statements by November 14, 2023

- Other customary closing conditions

- Termination:

- Standard termination clauses

- No termination fee

- Advisors:

- SPAC Legal Advisors: Loeb & Loeb LLP

- Target Legal Advisors: Brunson Chandler & Jones, PLLC

- Target M&A Advisors: CHW Strategic Advisors

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- No information available

*Denotes estimated figures by CPC

#Calculated as on October 19, 2023