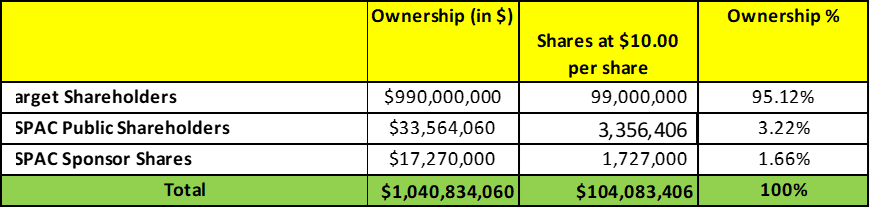

- HHG Capital Corporation (HHGC) to merge with Perfect Hexagon Group Limited (Private) in a transaction valuing the pro forma entity at *$1,005 million in Enterprise Value (*$1040 million equity value) assuming zero redemptions from the current level of 41.63%.

- Perfect Hexagon Group Limited shareholders will receive an equity consideration of $990 million at $10.0 per share.

- No minimum cash condition.

- No termination fees.

- Business combination transaction is targeted to close in the fourth quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Ordinary Share + 1 Redeemable Warrant + 1 Right

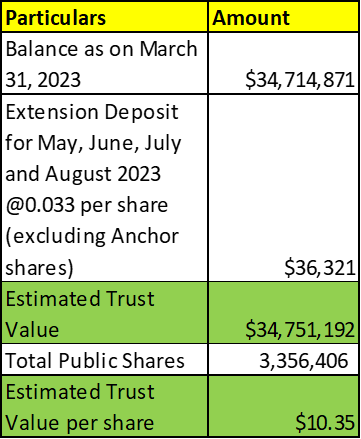

- #Cash in Trust: $34,751,192 million (103.5 % of Public Offering)

- Public Shares Outstanding: 3,356,406 shares (includes 3,084,000 shares held by Anchor Investors)

- Private Shares Outstanding: 1,982,000 shares (including 255,000 Private shares contained in Private Units)

- Trust Value/Share: $10.35

- Current Liquidation Date: August 23, 2023

- Outside Liquidation Date: September 23, 2023

- Name of Target: Perfect Hexagon Holdings Limited

- Target Description: PH is a Malaysia based leading non-financial institution market maker of commodities in Asia, as well as a physical commodity trading house focusing on precious metal and base metals.

- Announced Date: August 3, 2023

- Expected Close: “Fourth Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1822886/000149315223026884/ex99-1.htm

- Transaction Terms:

| Redemption Rate | 0% from current level of 41.6% |

| Share Price | $10.0 per share |

| Enterprise Value | *$1005 million (*$1040 million – *$34.75 million) |

| Market Cap Value | *$1040 million |

Note: SPAC sponsor shares excluding 255,000 Private Shares contained in Private Units

- Target Shareholders Receive (*~95.1%):

- Equity consideration of $990 million at $10.0 per share (99.0 million Purchaser Ordinary Shares)

- SPAC Shareholders Receive (*~3.22%):

- 3.35 million Purchaser Ordinary Shares (1 for 1)

- SPAC Sponsor Receive (*~1.66%):

- 1.73 million Purchaser Ordinary Shares (1 for 1)

- PIPE / Financing:

- Nil

- Redemption Protections:

- Nil

- Lock-up:

- SPAC Sponsor: 1-year post-closing

- Early Release: If the price equals or exceeds $12.0 per share after 150 days post-closing

- Key Target shareholders: 1-year post-closing

- SPAC Sponsor: 1-year post-closing

- Closing Conditions:

- Termination date: December 31, 2023

- No minimum cash condition

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clauses

- Financials:

- No financials provided

- Comparable:

- No valuation provided

- Advisors:

- SPAC Legal Advisor: Loeb & Loeb LLP

- Equity Incentive Plan:

- Share reserve as mutually decided

*Denotes estimated figures by CPC

#Estimated as on 3rd August, 2023