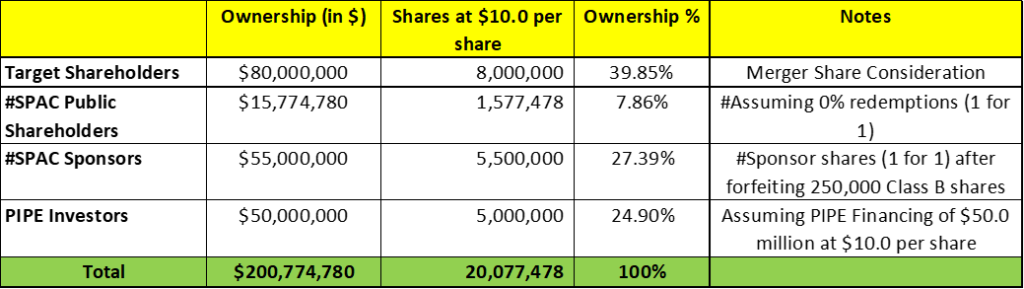

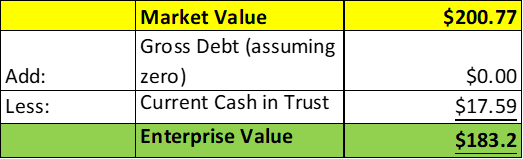

- AltEnergy Acquisition Corp. (AEAE) to acquire Car Tech (Private) in a transaction valuing the pro forma entity at *$183 million in Enterprise Value (*$201 million of equity value assuming no further redemptions).

- Car Tech shareholders will receive an equity consideration of $80.0 million subject to adjustments and will also get $40.0 million as earnout consideration. Half unlocks at $14.0 per share, and the rest at $18.0 per share.

- AEAE is required to raise $50.0 million in PIPE at $10.0 per share. Any deficiency will be adjusted from aggregate consideration of $80.0 million if Car Tech waives this condition.

- Sponsor agreed to subject 4.00 million (or *69.6%) sponsor shares to earnout provisions similar to company earnouts.

- The Sponsor will transfer 4.80 million Private Warrants (or *40%) to Car Tech Members upon closing. They’ll also grant Shinyoung an option to buy the remaining 7.20 million Private Warrants (or *60%) at $4.00 per Warrant. Additionally, the Sponsor will forfeit 250,000 shares (or *4.35%l) as part of the Non-Redemption Agreements.

- No termination fees.

- Business combination transaction is targeted to close in the first half of 2024.

- SPAC Details:

- Unit Structure: 1 Share of Class A Common Stock + 0.5 Redeemable Warrant

- #Cash in Trust: $17,591,536 (~112.2% of Public Offering)

- Public Shares Outstanding: 1,577,478 shares

- Private Shares Outstanding: 5.75 million shares

- Reported Trust Value/Share: $11.22 per share

- Current Liquidation Date: May 2, 2024

- Outside Liquidation Date: May 2, 2024

- Name of Target: Car Tech (a U.S. stamped auto-body parts manufacturer & subsidiary of leading Korean supplier, Shinyoung Co., Ltd)

- Description of Target: With over 50 years of technical expertise in the metal stamping industry, Shin Young Group was established as Shin-A Metal Company in 1974. Today, Shin Young and its affiliates provide body parts, molds, and automation solutions to major automotive companies worldwide, including in Korea, China, the U.S., and Germany. Car Tech was founded in 2016 to lead Shinyoung’s expansion of U.S. sales while being strategically positioned to diversify overseas sales and expand in the U.S. market. Car Tech is a Tier-One supplier that directly supplies parts to BMW, Volvo, and Volkswagen and is scheduled to supply battery cases for electric vehicles to BlueOval SK beginning in 2025.

- Announced Date: February 21, 2024

- Expected Close: “First half of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1852016/000119312524041599/d131439dex991.htm

- Transaction Terms (N/A):

- Transaction share price: $10.0 per share

- Pro Forma Equity Value: *$200 million

- Pro Forma Enterprise Value: *$183 million

- Target Shareholders Receive (~*40%):

- Equity consideration of $80.0 million at $10.0 per share subject to adjustments:

- $80.0 million – Parent Shortfall Amount ($50.0 million – Actual PIPE Raised)

- Provided Target is willing to waive the PIPE Financing condition

- $80.0 million – Parent Shortfall Amount ($50.0 million – Actual PIPE Raised)

- Earnout Consideration of $40.0 million at $10.0 per share:

- Block-A Earnout Shares: 2.0 million shares at $14.0 per share

- Block A-1 Earnout Shares: 1.85 million shares (20/30 trading days during 5 years post-closing)

- Block A-2 Earnout Shares: 0.15 million shares (20/30 trading days during 10 years post-closing)

- Block-B Earnout Shares: 2.0 million shares at $18.0 per share (20/30 trading days during 10 years post-closing)

- Block-A Earnout Shares: 2.0 million shares at $14.0 per share

- PIPE / Financing:

- SPAC is required to raise $50.0 million in PIPE at $10.0 per share

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Sponsor agreed to subject 4.00 million (or *69.57%) sponsor shares to earnout conditions:

- Block-A Earnout Shares: 2.0 million shares at $14.0 per share

- Block A-1 Earnout Shares: 1.85 million shares (20/30 trading days during 5 years post-closing)

- Block A-2 Earnout Shares: 0.15 million shares (20/30 trading days during 10 years post-closing)

- Block-B Earnout Shares: 2.0 million shares at $18.0 per share (20/30 trading days during 10 years post-closing)

- Block-A Earnout Shares: 2.0 million shares at $14.0 per share

- Sponsor has agreed to transfer 4.80 million Private Warrants (*40%) to Car Tech Members at closing

- Sponsor and B. Riley have agreed to grant to *Shinyoung an option to purchase the remaining 7.20 million Private Warrants (*60%) for $4.00 per Warrant (*Shinyoung is a 78.32% holder of the Car Tech Units & holder of a significant portion of the Car Tech’s outstanding indebtedness)

- Sponsor shall forfeit 250,000 shares (*4.35%) to reserve in connection with Non-Redemption Agreements (NRAs)

- Lock-up:

- Lock-up Holders: Holders of Company Units, shares of Parent Common Stock, or Private Placement Warrants

- Lock-up Period:

| % of Lock-up shares | Lock-up Period |

| 50% | 12 months post-closing |

| 25% | 18 months post-closing |

| 25% | 24 months post-closing |

- Closing Conditions:

- Termination date: October 31, 2024

- If SPAC doesn’t get the full $50.0 million of PIPE Financing, Target can still decide to proceed with the merger, but the deal’s terms might change to adjust for the shortfall

- However, any money raised from investors in Asia or Canada that the Company introduced to Parent won’t count towards the shortfall

- Target needs to give a standard notice about the Merger to the Bank of Korea, as the law requires and also a need confirmation from the Bank of Korea that the notice has been accepted

- SPAC Minimum PIPE Proceeds of $50.0 million

- Sponsor Forfeiture to reserve 250,000 shares for future NRAs (See under “Support Agreement”)

- PCAOB Financials by March 31, 2024

- Other customary closing conditions

- Termination:

- No termination fee

- Other standard termination clause

- Advisors:

- SPAC Financial Advisor: GLC Advisors & Co., LLC

- Target Financial Advisor: Finhaven Capital Inc.

- SPAC Legal Advisor: Morrison Cohen LLP

- Target Legal Advisor: Dorsey & Whitney LLP

- Financials (N/A):

- No financials or projections provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan

- Approve & adopt an incentive equity plan at closing on terms mutually acceptable to both parties

*Denotes estimated figures by CPC

#Reported as on December 31, 2023