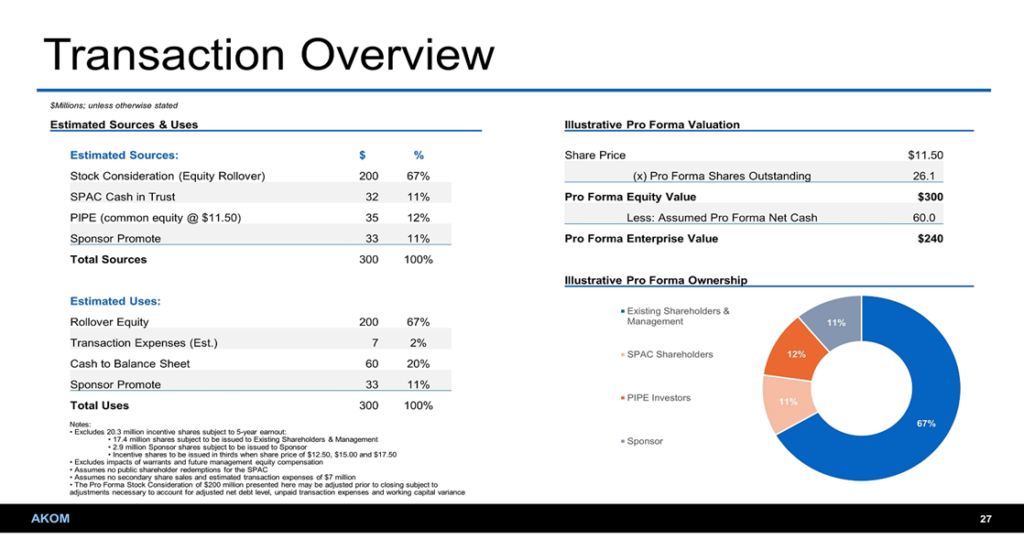

- IX Acquisition Corp. (IXAQ) to acquire AERKOMM (Euronext: AKOM, OTCQX: AKOM) in a transaction valuing the pro forma entity at $240 million in Enterprise Value ($300 million equity value assuming zero redemptions from the current level).

- AERKOMM shareholders will receive equity consideration of $200 million at $11.5 per share and 17.4 incentive (earnout) shares at price triggers of $12.5, $15.0 and $17.5 respectively.

- Transaction is supported by a fund-raise of $35.0 million common equity PIPE subscribed concurrently with the signing of the BCA. The PIPE investors consist of new and current shareholders in AERKOMM. There may be more capital raised prior to the business combination, but there is no minimum cash condition for the transaction.

- The agreement includes a termination fee payable by AERKOMM of $5.00 million (or $12.0 million in some cases) if IXAQ terminates under default conditions.

- Business combination transaction is targeted to close in the third quarter of 2024.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.5 Redeemable Warrant

- #Cash in Trust: $31,590,528 (111.0% of Public Offering; including extension contribution of $150,000 till April 12th , 2024)

- Public Shares Outstanding: 2,846,071 shares

- Private Shares Outstanding: 5,750,000 shares (including 4,002,121 Class A Shares)

- Estimated Trust Value/Share: $11.1

- Current Liquidation Date: April 12, 2024

- Outside Liquidation Date: October 12, 2024

- Name of Target: AERKOMM (Listed on OTCQX & Euronext)

- Description of Target: AERKOMM is an innovative satellite technology company, providing carrier-neutral and software- defined infrastructure for multi-orbit, end-to-end satellite broadband connectivity, serving both public and private sectors, including Aerospace & Defense and Civilian Telecommunications. AERKOMM has a range of next-generation satellite technologies that offer broadband connectivity by collaborating with satellite partners and mobile network operators to link users and platforms on the edge to core infrastructure hubs.

- Announced Date: March 29, 2024

- Expected Close: “Third Quarter of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1852019/000110465924043675/tm2410245d1_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1852019/000110465924043675/tm2410245d1_ex99-2img027.jpg):

- Transaction Share Price: $11.5

- Pro Forma Enterprise Value: $240 million

- Pro Forma Equity Value: $300 million

- Target Shareholders Receive (~67%):

- Equity consideration of ~$200 million at $11.5 per share

- 50%*$400 million – Adjusted Closing Net Debt – Unpaid Company Transaction Expenses + Working Capital Variance

- 17,391,304 Incentive Shares (5 years earnout): 50%*$400 million at $11.5 per share

- 5,797,101 shares at $12.50 per share

- 5,797,101 shares at $15.00 per share

- 5,797,101 shares at $17.50 per share

- Equity consideration of ~$200 million at $11.5 per share

- PIPE / Financing:

- SPAC is expected to raise $35.0 million at $11.5 per share of SPAC common stock by closing

- Target will exercise reasonable best efforts to obtain a PIPE Investment Amount of at least $65.0 million (including SAFE Agreements) and will obtain a minimum PIPE Investment Amount of at least $45.0 million minus the investment amount obtained under SAFE Agreements

- The SAFE Investment:

- Target will enter into simple agreements for future equity with certain investors providing for investments in shares of Target Common Stock in a private placement in an aggregate amount not less than $15.0 million exercising reasonable best efforts to secure:

- $5.00 million within 20 Business Days of March 29, 2024 (Agreement Date)

- $5.00 million within 40 Business Days of March 29, 2024

- $5.00 million within 60 Business Days of March 29, 2024

- Above will automatically convert upon the Closing at $11.5 per share of Parent Common Stock

- Target will enter into simple agreements for future equity with certain investors providing for investments in shares of Target Common Stock in a private placement in an aggregate amount not less than $15.0 million exercising reasonable best efforts to secure:

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Sponsor agreed to subject 2.90 million shares (or *50.4%) to earnout provisions similar to company earnouts

- Lock-up:

- SPAC Sponsor: 1 year post-closing

- Early release: If price equals or exceeds $12.0 per share after 150 days post-closing

- Target Shareholders: 12 months post-closing

- SPAC Sponsor: 1 year post-closing

- Closing Conditions:

- Termination date: October 12, 2024

- Extendable by 6 months if SEC has not declared the Registration Statement and Proxy Statement effective on or prior to October 12, 2024

- The PIPE Investment shall have been consummated with gross proceeds not less than $45.0 million

- No minimum cash condition

- PCAOB Financials by April 15, 2024

- Other customary closing conditions

- Termination date: October 12, 2024

- Termination:

- If the agreement is validly terminated by SPAC due to:

- breach by Target of any representation, warranty, agreement or covenant:

- Target shall pay a Termination Fee equal to the lower of:

- Parent Reimbursable Termination Expenses*1.5 OR $5.00 million (Cause Termination Fee)

- any Company Change of Recommendation or Company Superior Proposal:

- Target shall pay a Termination Fee equal to:

- $12.00 million (Non- Cause Termination Fee)

- Target shall pay a Termination Fee equal to:

- Target shall pay a Termination Fee equal to the lower of:

- breach by Target of any representation, warranty, agreement or covenant:

- Other standard termination clauses

- If the agreement is validly terminated by SPAC due to:

- Advisors:

- SPAC Legal Advisors: Loeb & Loeb LLP

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Parent Equity Incentive Plan

- 15% of shares outstanding post-closing

- Underwriting Agreements:

- On April 4, 2024, SPAC renegotiated agreements with Cantor Fitzgerald & Co. and Odeon Capital Group LLC, reducing their deferred fees upon closing:

- Cantor Fitzgerald & Co. agreed to forfeit $6,475,000, resulting in a reduced payment of $1,995,000

- Odeon Capital Group LLC forfeited $2,775,000, resulting in a reduced payment of $855,000

- These adjusted payments are to be made solely in cash, in U.S. dollars, without any deductions

- On April 4, 2024, SPAC renegotiated agreements with Cantor Fitzgerald & Co. and Odeon Capital Group LLC, reducing their deferred fees upon closing:

*Denotes estimated figures by CPC

#Estimated as on April 9, 2024