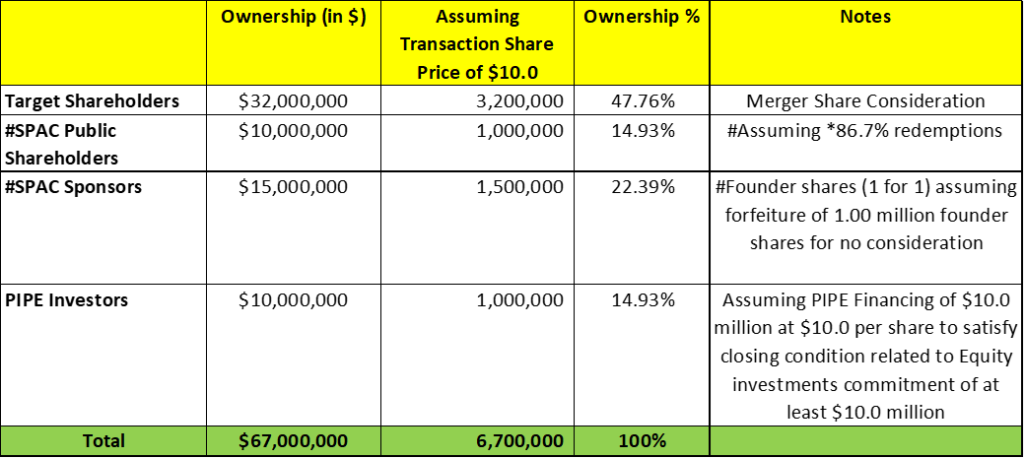

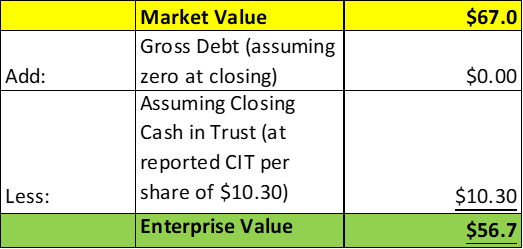

- 99 Acquisition Group Inc. (NNAG) to merge with Nava Health MD, Inc (Private) in a transaction valuing the pro forma entity at *$56.7 million in Enterprise Value (*67.0 million of pro forma equity value assuming redemption of *86.7% and PIPE of *$10.0 million).

- Nava shareholders will receive equity consideration of ~$320 million at $10.0 per share subject to debt adjustment.

- Sponsor agreed to forfeit 1.00 million (or *40%) sponsor shares for no consideration.

- Minimum net cash condition of $20.0 million.

- If the agreement is terminated because one party has breached certain representations, warranties, agreements, or covenants before closing, the other party will be obligated to reimburse for its transaction costs, up to a maximum of $0.30 million.

- Business combination transaction is targeted to close in the second quarter of 2024.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 1 Redeemable Warrant + 1 Right

- #Cash in Trust: $77,225,243 (103% of Public Offering)

- Public Shares Outstanding: 7.50 million shares

- Private Shares Outstanding: 2.50 million shares

- Reported Trust Value/Share: $10.3 per share

- Current Liquidation Date: May 22, 2024

- Outside Liquidation Date: November 22, 2024

- Name of Target: Nava Health MD, Inc.

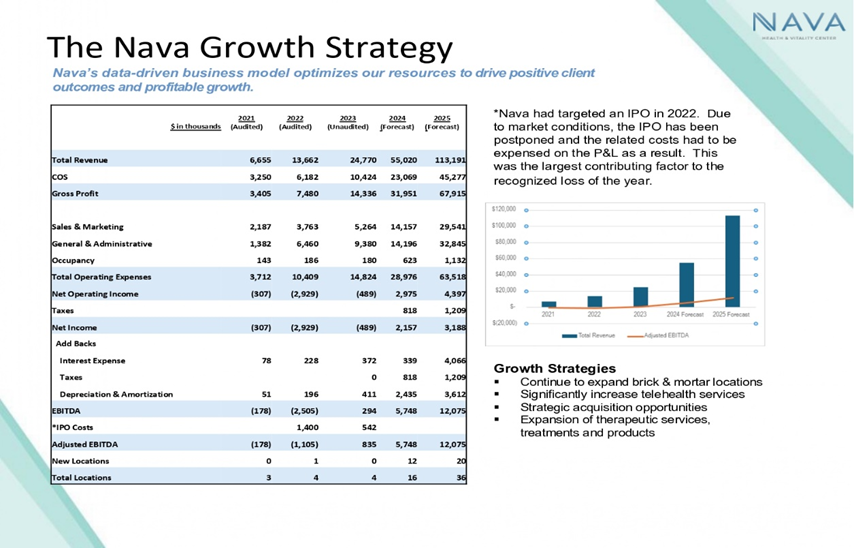

- Description of Target: Nava Health is a leading integrative medical center committed to providing client-centered, functional, and integrative healthcare. With a team of highly skilled medical professionals and a dedication to cutting-edge technology, Nava Health aims to redefine the healthcare experience. By combining traditional medicine with complementary therapies, Nava Health delivers personalized care that addresses the root causes of health issues. Nava Health is at the forefront of the integrative healthcare movement with multiple centers nationwide.

- Announced Date: February 13, 2024

- Expected Close: “Second Quarter of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1950429/000121390024013634/ea193040ex99-1_99acquis.htm

- Transaction Terms (N/A):

- Pro Forma Equity Value: *$67.0 million

- Pro Forma Enterprise Value: *$56.7 million

- Target Shareholders Receive (*47.8%):

- Equity consideration of $320 million subject to adjustment of closing net debt in excess of $9.50 million:~32.0 million shares at $10.0 per share

- PIPE / Financing:

- Nil

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Sponsor agreed to forfeit 1.00 million (or *40%) sponsor shares for no consideration

- Lock-up:

- Sponsor: 1-year post-closing

- Early Release: If the price equals or exceeds $12.0 per share after 150 days post-closing

- Key Target Shareholders: 6 months post-closing

- Sponsor: 1-year post-closing

- Closing Conditions:

- Termination date: June 30, 2024

- Minimum NET Cash Condition of 20.0 million

- Cash includes: CIT – Redemptions + Equity/Debt Financing – Transaction Costs (not exceeding $1.00 million)

- Equity Investments Commitments ≥ $10.0 million by February 29, 2024 (for Minimum Cash Condition)

- Dissenting shares ≤ 5%

- Sponsor Forfeiture Agreement shall have been entered into and shall continue to be in full force and effect

- Other customary closing conditions

- Termination:

- Reimbursement of Breach:

- if the agreement is terminated because one party has breached certain representations, warranties, agreements, or covenants before closing, the other party will be obligated to reimburse for its transaction costs, up to a maximum of $0.30 million

- Reimbursement of Breach:

- Advisors:

- Target Legal Advisors: Gordon Feinblatt LLC

- SPAC Legal Advisors: Loeb & Loeb LLP

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan

- 10% of combined company shares at closing

*Denotes estimated figures by CPC

#Reported as on December 31, 2023