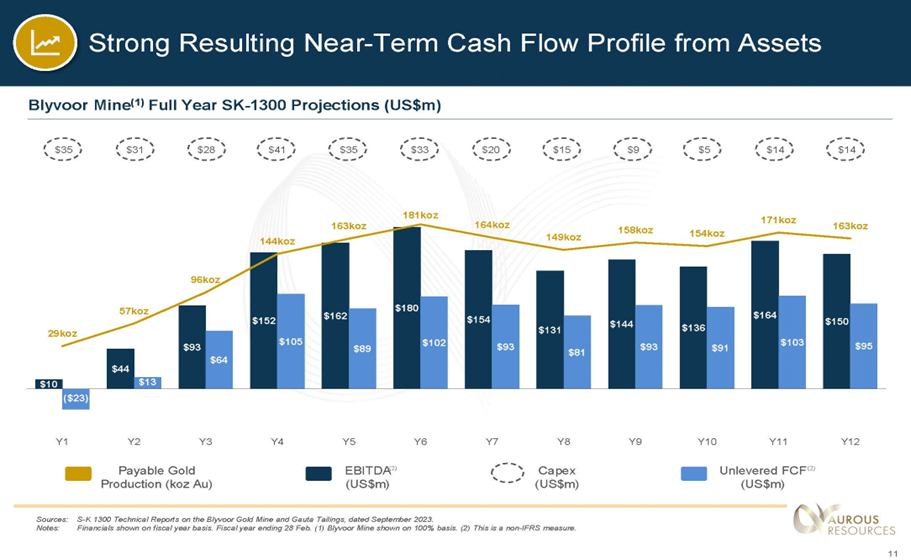

- Blyvoor Gold Resources Proprietary Limited and Blyvoor Gold Operations Proprietary Limited (together, Aurous or the Target Companies), a producing mining group which owns the Blyvoor gold mine (Blyvoor Mine) and the Gauta tailings retreatment project (Gauta Tailings), and Rigel Resource Acquisition Corp (RRAC), sponsored by a fund managed by Orion Resource Partners (Orion), one of the world’s foremost, mining-focused alternative investment firms, have entered iinto a definitive business combination agreement that will result in Aurous becoming publicly traded.

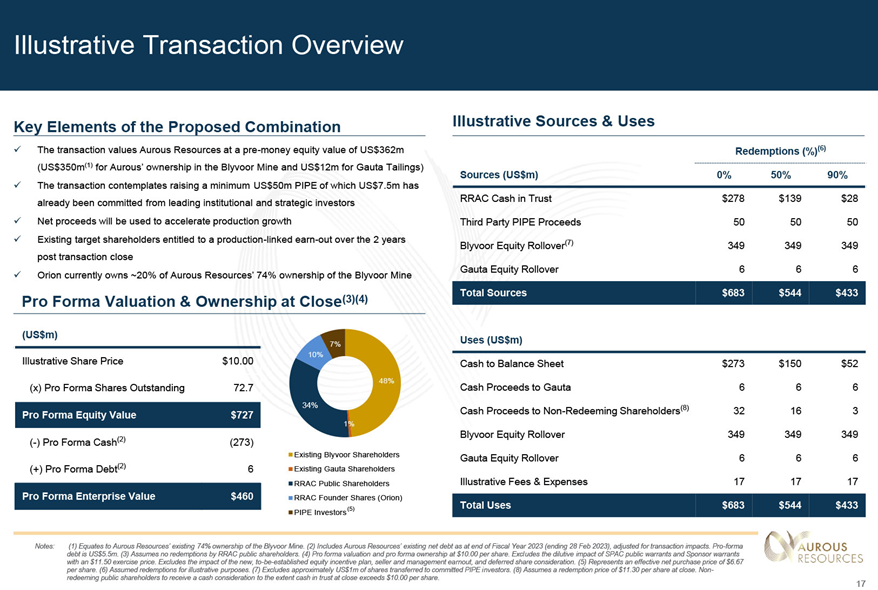

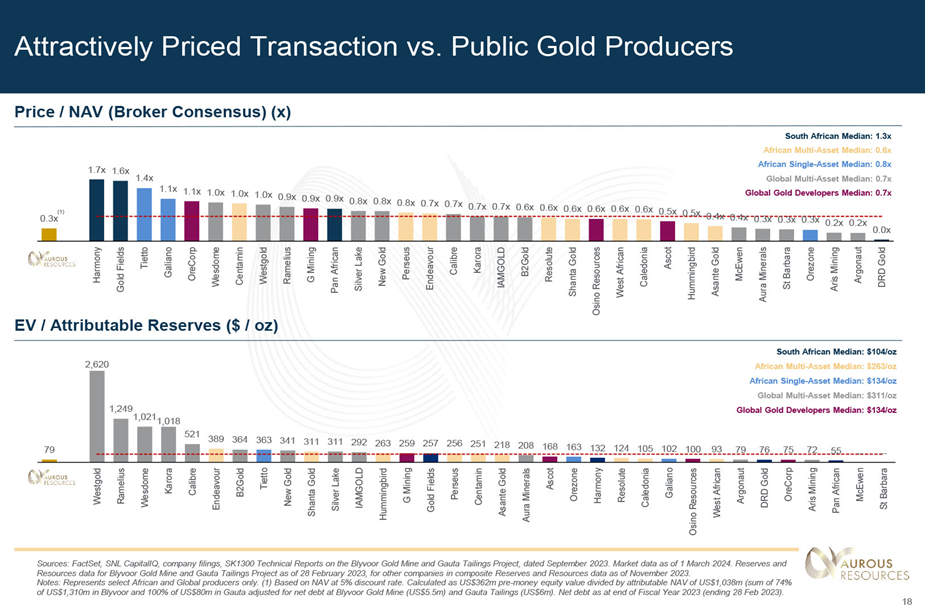

- Rigel Resource Acquisition Corp. (RRAC) to merge with Aurous (Private) in a transaction valuing the pro forma entity at $460 million in Enterprise Value ($727 million of equity value assuming no further redemptions from current level).

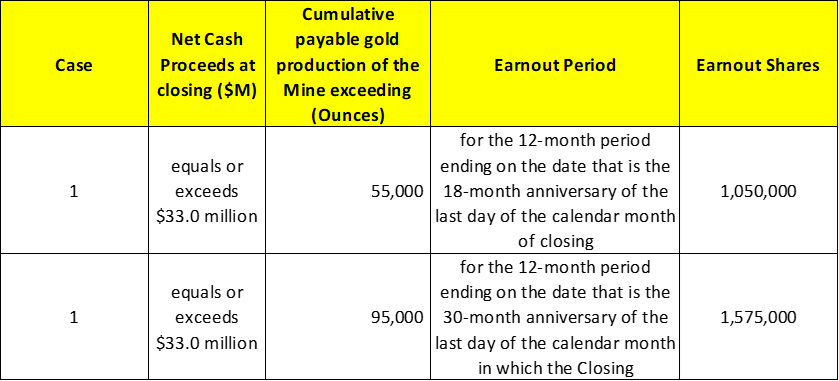

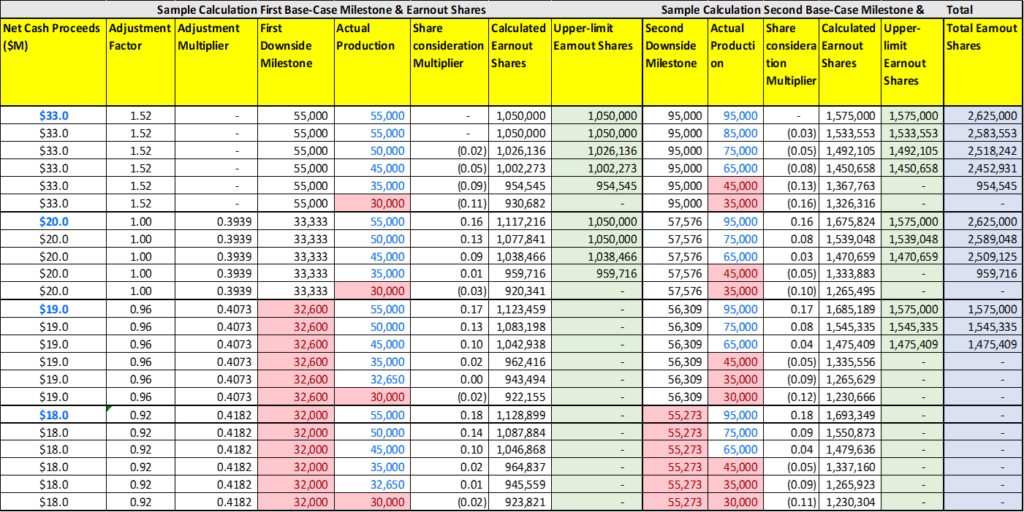

- Aurous shareholders will receive aggregate consideration of 35.6 million Newco Ordinary Shares at $10.0 per share and earnout consideration of up to 2.65 million shares subject to certain milestones.

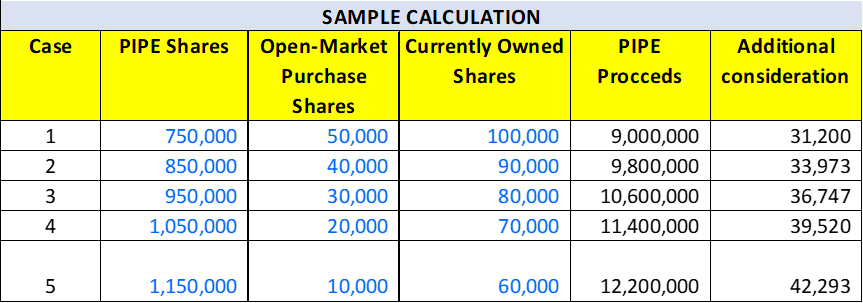

- Blyvoor Gold, in exchange for its shares of Tailings, will receive additional consideration within 90 days after the closing calculated as PIPE Investment proceeds divided by 100,000 and multiplied by 346.67.

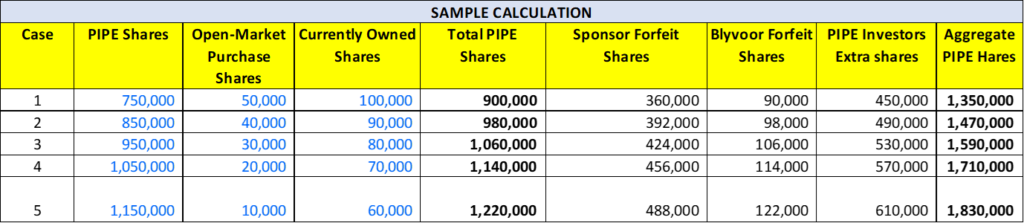

- The transaction contemplates raising a minimum $50.0 million PIPE of which $7.50 million has already been committed from leading institutional & strategic investors. Additionally, each PIPE Investor will receive a number of Newco Ordinary Shares equivalent to the sum of the Sponsor Forfeit Shares and the Blyvoor Forfeit Shares, without any extra cash consideration.

- The Sponsor has committed to forfeit shares to PIPE investors, with the calculation being 4 times the total PIPE Shares divided by $10.0.

- Minimum gross cash condition of $50.0 million.

- No termination fees.

- Business combination transaction is targeted to close in the second half of 2024.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 0.5 Redeemable Warrant

- #Cash in Trust: *$266,639,182 (*108.7% of Public Offering)

- Public Shares Outstanding: 24,570,033 shares

- Private Shares Outstanding: 7,500,000 shares

- Estimated Trust Value/Share: *$10.87

- Current Liquidation Date: December 9, 2024

- Outside Liquidation Date: August 9, 2024

- Name of Target: Aurous (Blyvoor Gold)

- Description of Target: Aurous is a South African gold mining company operating the Blyvoor Mine on Johannesburg’s West Rand. The company is led by an agile leadership team and strong investors, who have built a quality, long-term, profitable mining asset offering steady growth and low costs.

- Announced Date: March 11, 2024

- Expected Close: “Second Half of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1860879/000182912624001510/rigelresource_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1860879/000182912624001510/ex99-2_019.jpg):

- Pro Forma Equity Value: $727 million

- Pro Forma Enterprise Value: $460 million

- SPAC Public Shareholders Receive:

- Cash consideration (~$32.0 million): Cash value per share – $10.0

- Stock consideration: 1 Newco Ordinary Share for every 1 Class A share

- Newco Public Warrants SPAC Public Warrants

- SPAC Sponsors Receive:

- Stock consideration: 1 Newco Ordinary Share for every 1 Class B share

- Newco Private Warrants equal to SPAC Private Warrants

- Target Shareholders Receive (~49%):

- Aggregate consideration of 35.6 million shares

- Gold Tailings Consideration: 600,000 Newco Ordinary Shares

- Gold Resources Consideration: 28,017,500 Newco Ordinary Shares

- Orion Resources Consideration: 6,982,500 Newco Ordinary Shares

- Aggregate consideration of 35.6 million shares

- Blyvoor Gold, in exchange for its shares of Tailings, will receive additional consideration within 90 days after the closing calculated as: PIPE Investment proceeds ÷ 100,000 * 346.6666667.

- Earnout shares:

- If Net Cash Proceeds equals or exceeds $33.0 million at closing:

- If Net Cash Proceeds are less than $33.0 million at closing:

- PIPE / Financing:

- Common Stock PIPE of $7.50 million at $10.0 per share (750,000 Newco Ordinary Shares)

- A PIPE Investor is allowed to reduce their obligation to purchase PIPE Shares by purchasing Rigel Class A Ordinary Shares in open market at a price lower than the Closing redemption price, provided they agree not to sell, vote, or redeem those shares

- PIPE Investors who already own Rigel Class A Ordinary Shares can similarly reduce their obligation by agreeing not to sell or transfer those shares, voting them in favor of the Transactions, and refraining from redeeming them

- In addition, each PIPE Investors will receive a number of Newco Ordinary Shares equal to the:

- Sum of the Sponsor Forfeit Shares and the Blyvoor Forfeit Shares for no additional cash consideration:

- Sponsor Forfeit Shares: 4* Total PIPE Shares ÷ $10.0

- Blyvoor Forfeit Shares: 1* Total PIPE Shares ÷ $10.0

- Sum of the Sponsor Forfeit Shares and the Blyvoor Forfeit Shares for no additional cash consideration:

- Common Stock PIPE of $7.50 million at $10.0 per share (750,000 Newco Ordinary Shares)

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Sponsor agreed to forfeit shares to PIPE investors: 4* Total PIPE Shares ÷ $10.0 (see above under PIPE Financing section)

- Lock-up:

- SPAC sponsor:

- Newco Ordinary Shares: 12 months post-closing

- Early release: If the price equals or exceeds $12.0 per share after 180 days post-closing

- 40% Newco Private Warrants: 12 months post-closing

- 60% Newco Private Warrants: 24 months post-closing

- Newco Ordinary Shares: 12 months post-closing

- Target Shareholders:

- Newco Ordinary Shares: 6 months post-closing

- SPAC sponsor:

- Closing Conditions:

- Termination date: August 9, 2024

- Minimum gross cash condition of $50.0 million

- Cash includes: CIT – Redemptions + PIPE Financing + Funding under Orion Forward Purchase Agreement – Aggregate Cash Consideration

- Target Group Company Transaction Expenses + Rigel Transaction Expenses ≤ $17.0 million

- PCAOB consolidated audited financials for:

- by April 1, 2024 for fiscal year ended February 28, 2023

- by May 30, 2024 for fiscal year ended February 29, 2024

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clause

- Advisors:

- SPAC Legal Advisor: Sidley Austin LLP and Bowmans

- Target Legal Advisor: Milbank LLP and ENS

- SPAC Capital Market Advisor: Citigroup Global Markets Inc.

- Target Financial Advisor: Rand Merchant Bank

- Co-Placement Agents: Citi and Hannam & Partners

- Citi and Hannam Legal Advisor: Davis Polk & Wardwell LLP

- Equity Incentive Plan

- 7.5% of aggregate Newco Ordinary Shares at closing

- 2.0% annual automatic increase under evergreen provision

*Denotes estimated figures by CPC

#Estimated as on November 14, 2024