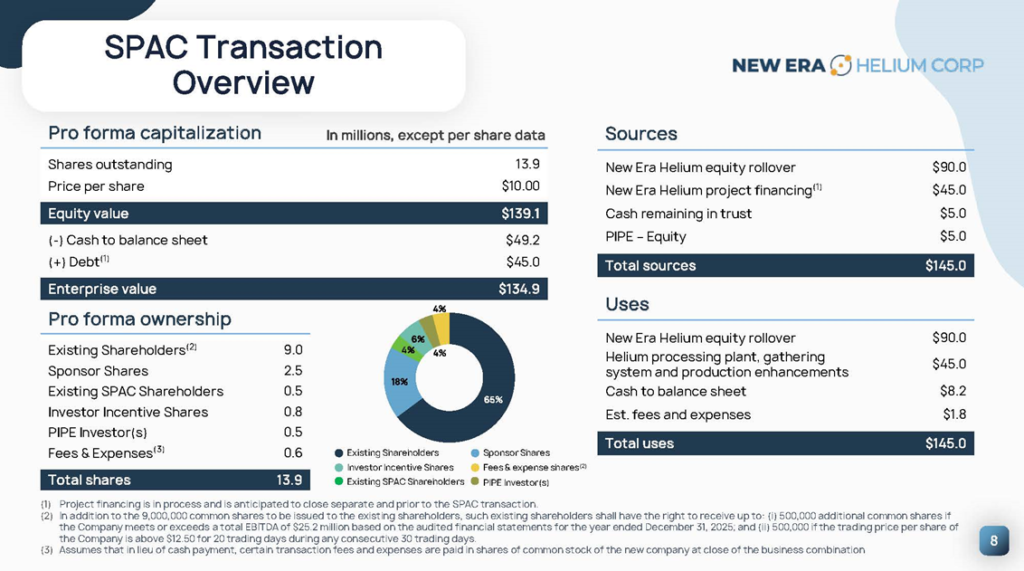

- Roth CH Acquisition V Co. (ROCL) to acquire New Era Helium Corp. (Private) in a transaction valuing the pro forma entity at $135 million in Enterprise Value ($139 million of equity value assuming $5.00 million remaining in Trust Account and PIPE raise of $5.00 million).

- NEH shareholders will receive equity consideration of $90.0 million at $10.0 per share subject to net debt adjustments and earnout consideration of 1.00 million shares. The earnout consideration consists of 1.00 million shares, divided into two conditions: 0.50 million shares are contingent upon Total EBITDA reaching or surpassing $25.268 million as per audited financial statements for the year ended December 31, 2025, while another 0.50 million shares are dependent on the average reported sales price on NASDAQ equalling or exceeding $12.5 per share between the period from closing to 180 days after the filing of the Form 10-K for the fiscal year ended December 31, 2025.

- ROCL anticipates raising a PIPE of $5.00 million at $10.0 per share. Additionally, ROCL commits to making commercially reasonable efforts to secure additional financing from third-party sources in various forms such as equity, equity-linked, convertible equity, preferred, or debt investments.

- Sponsors have the option to utilize up to 836,500 of their shares (or *29.1%) as incentives for Transaction Financing Investors.

- After securing Transaction Financing and distributing the Trust Fund, ROCL must retain a minimum of $5.00 million in cash and similar assets at closing.

- No termination fees.

- ROCL and NEH have agreed to terminate their Business Combination Marketing Agreement with Roth Capital Partners, LLC and Craig-Hallum Capital Group LLC by issuing the advisors a total of 575,000 unrestricted shares, exempt from any transfer restrictions.

- Business combination transaction is targeted to close in the first half of 2024.

- SPAC Details:

- Unit Structure: 1 Share of Common Stock + 0.5 Right

- #Cash in Trust: $16,946788 (*107.1% of Public Offering; including 2 extension payments of $45,000 each)

- Public Shares Outstanding: 1,582,797 shares

- Private Shares Outstanding: 3,336,500 shares (including 461,500 shares contained in Private Units)

- Estimated Trust Value/Share: *$10.71

- Current Liquidation Date: February 3, 2024

- Outside Liquidation Date: December 3, 2024

- Name of Target: New Era Helium Corp.

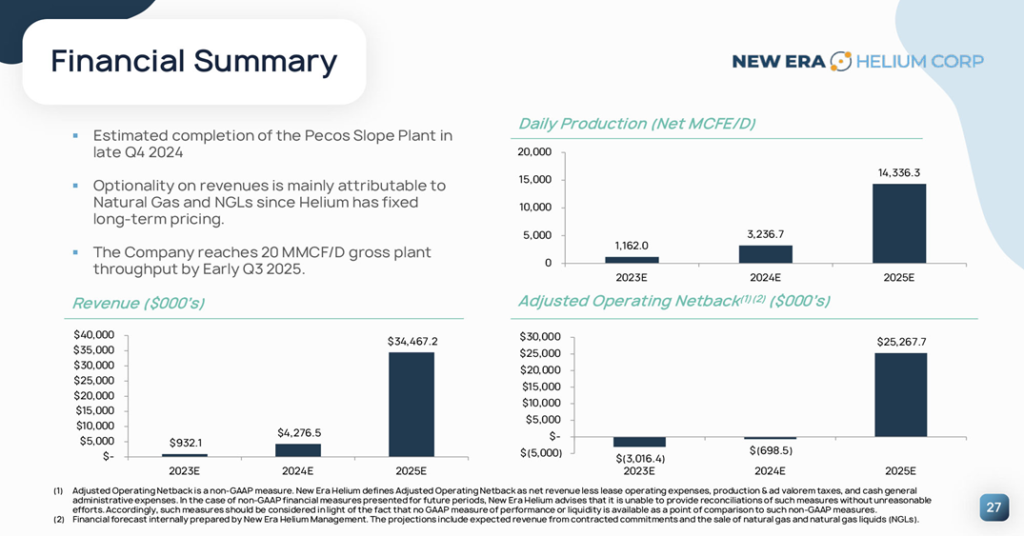

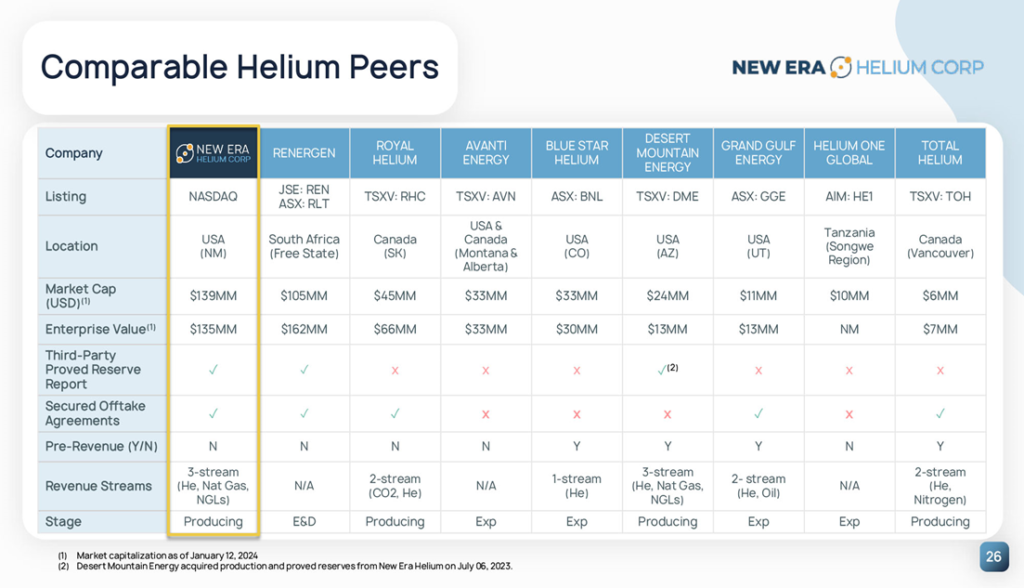

- Description of Target: NEH is an exploration and production company that sources helium produced in association with the production of natural gas reserves in North America. The company currently owns and operates over 137,000 acres in Southeast New Mexico and has over 2 billion cubic feet of proved, and probable helium reserves.

- Announced Date: January 4, 2024

- Expected Close: “First half of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1885998/000182912624000029/rothchacquisition5_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1885998/000182912624000233/ex99-2_008.jpg):

- Pro Forma Equity Value: $139.1 million

- Pro Forma Enterprise Value: $134.9 million

- Target Shareholders Receive (~66%):

- Equity consideration of $90.0 million at $10.0 per share subject to adjustment based upon the Net Debt:

- Above amount assumes $37.3 million Net Debt

- For every dollar of Net Debt < $37.3 million, Merger Shares will be increased by 1/10 of one share

- For every dollar of Net Debt > $37.3 million, Merger Shares will be decreased by 1/10 of one share

- Earnout Consideration: 1.00 million shares:

- 500,000 Earnout Shares if Total EBITDA equals or exceeds $25.268 million based upon the audited financial statements for the year ended December 31, 2025

- 500,000 Earnout Shares at average reported sales price on NASDAQ equals or exceeds $12.5 per share during the period between closing and 180 days after the filing of the Form 10-K for the fiscal year ended December 31, 2025

- Equity consideration of $90.0 million at $10.0 per share subject to adjustment based upon the Net Debt:

- PIPE / Financing:

- PIPE of $5.00 million is expected to be raised by SPAC at $10.0 per share

- SPAC shall use commercially reasonable efforts to identify additional sources of financing from third party financing sources in the form of equity, equity linked, convertible equity, preferred or debt investments and SPAC Insiders may use up to 836,500 of their shares (or *29.1%) to incentivize Transaction Financing Investors

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- SPAC Insiders may use up to 836,500 of their shares (or *29.1%) to incentivize Transaction Financing Investors

- Lock-up:

- SPAC sponsor (50%): 6 months post-closing

- Early release (50%): if price equals or exceeds $12.5 per share after closing

- Target Shareholders: 6 months post-closing

- SPAC sponsor (50%): 6 months post-closing

- Closing Conditions:

- Termination date: July 2nd, 2024 (~Closing should occur before 180 days after the date of the Merger Agreement)

- At closing, once Transaction Financing is done and the Trust Fund is distributed, SPAC needs to have at least $5.00 million in cash & similar assets left

- amount shall include all cash held by any subsidiary of SPAC (Roth) immediately following the closing, including, the Target

- Financial statements:

- Audited Financial Statements for the year ended December 31, 2022 and December 31, 2021 by January 8, 2024

- Interim Financials by February 1, 2024

- Audited Financial Statements for the year ended December 31, 2023 within 90 days after the date of the Merger Agreement

- Target must secure a minimum of $45.0 million through a private placement of securities to finance the construction of its new plant before closing

- Target’s debt must be converted into common stock shares of the Target

- Other customary closing conditions

- Termination:

- No Termination Fee

- Other standard termination clause

- Advisors:

- PIPE Placement Agents: Roth Capital Partners, LLC and Craig-Hallum Capital Group LLC

- Target Legal Advisor: Sichenzia Ross Ference Carmel LLP

- SPAC Legal Advisor: Loeb & Loeb LLP

- Equity Incentive Plan:

- No information provided

- Termination of Business Combination Marketing Agreement:

- SPAC and Target entered into a letter agreement with Roth Capital Partners, LLC and Craig-Hallum Capital Group LLC to terminate Business Combination Marketing Agreement (dated as of November 30, 2021) by issuing to the Advisors an aggregate of 575,000 shares

- Such shares will not be subject to any lock-up agreement or other restrictions on transfer

- SPAC and Target entered into a letter agreement with Roth Capital Partners, LLC and Craig-Hallum Capital Group LLC to terminate Business Combination Marketing Agreement (dated as of November 30, 2021) by issuing to the Advisors an aggregate of 575,000 shares

*Denotes estimated figures by CPC

#Reported as on November 17, 2023 (Plus two extension payments)