August 19, 2022

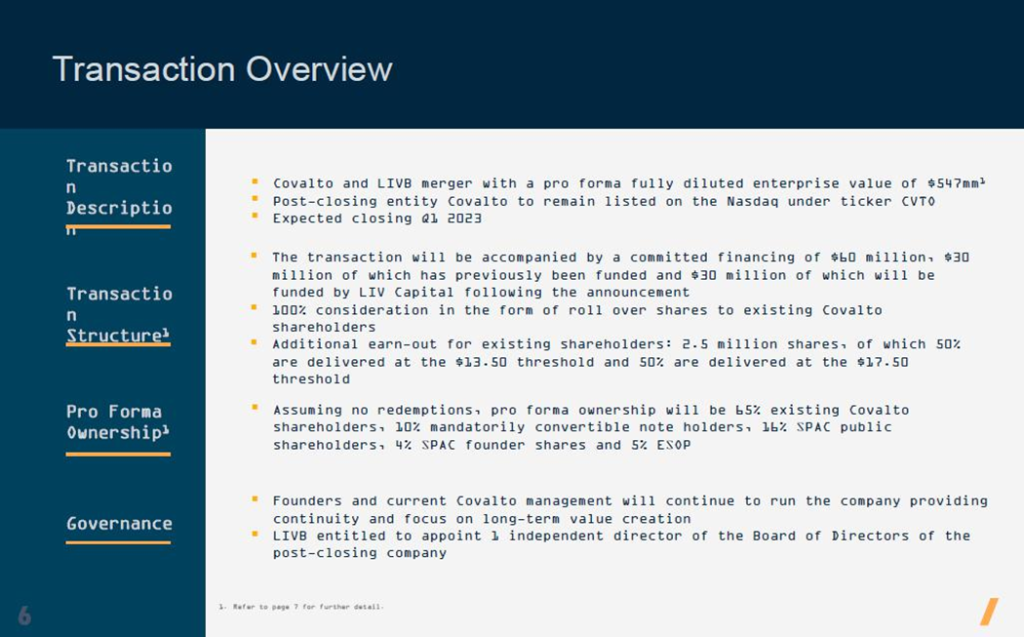

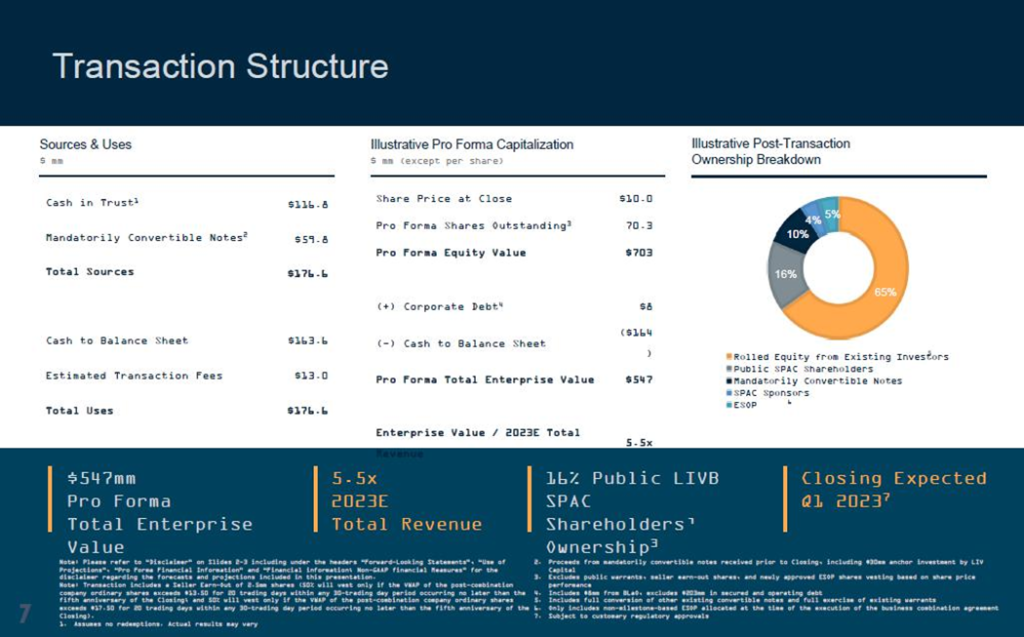

- LIV Capital Acquisition Corp. II (LIVB) to merge with Covalto (private) in a transaction valuing the pro forma entity at $547 million in Enterprise Value ($703 million equity value).

- LIV Capital public shareholders and sponsors will receive equal number of New Covalto Class A shares in exchange of LIV Capital shares.

- Existing Covalto shareholders will roll over 100% of their shares in “New Covalto”.

- Transaction includes of 2.5 million earnout shares to Covalto shareholders at $13.50 and $17.50/share.

- Transaction includes a committed financing of $60 million, $30 million of which has been previously funded by existing investors & $30 million will be funded by LIV Capital following the announcement.

- The agreement provides for a termination fee payable by Covalto to LIV Capital if it fails to perform its obligations & covenants. It can be paid in cash ($5.5 million) or in the form of preference shares of Covalto. Covalto will also be required to provide additional consideration to Convertible Notes Investors in the form of preference shares in case of termination.

- Business combination transaction is targeted to close in the first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 0.75 redeemable Warrant

- #Cash in Trust: $116,943,151 (102.1% of Public Offering)

- Public Shares Outstanding: 11.45 million

- Private Shares Outstanding: 2.8625 million

- Reported Trust Value/Share: $10.21

- Liquidation Date: May 10, 2023

- Outside Liquidation Date: August 10, 2023

- Name of Target: Covalto

- Description of Target: Founded in 2015, Covalto is a leading digital banking and services platform for SMEs in Mexico. The company provides a product ecosystem of lending, banking and business analytics solutions to support SMEs throughout their lifecycle via products that are superior in price, speed of delivery and quality of customer experience. The company uses a combination of cutting-edge software design, innovative applications of data science and advanced internal processes for decision making and product structuring.

- Announced Date: August 18, 2022

- Expected Close: “first quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1875257/000095010322014160/dp178653_ex9901.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1875257/000095010322014160/image_035.jpg & https://www.sec.gov/Archives/edgar/data/1875257/000095010322014160/image_036.jpg):

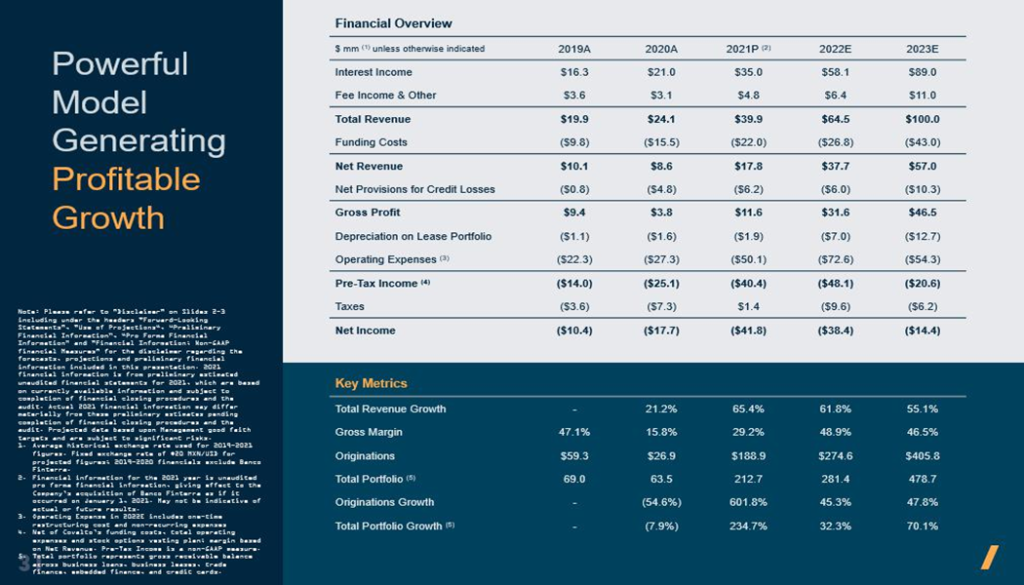

- Enterprise Value: $ 547 million, 5.5x 2023E Total Revenue

- Market Cap Value: $703 million

- SPAC Shareholders:

- SPAC Class A shareholders:

- *11.45 million New Covalto Class A Ordinary shares at $10/share

- *2.86 million New Covalto Class A Ordinary shares at $10/share

- LIVB Warrants will convert into New Covalto Warrants

- SPAC Class A shareholders:

- Target shareholders:

- Rollover of 100% equity:

- *45.695 million New Covalto Class A ordinary shares at $10/share (includes full exercise of existing warrants & full conversion of preferred shares)

- Earn-Out shares (with each Covalto Co-Founder receiving Covalto Class B Ordinary Shares & each other shareholder receiving Covalto Class A Ordinary Shares):

- 2.5 million common stock shares of New Covalto (5 years after closing)

- 1.25 million shares @ $13.50 per share

- 1.25 million shares @ $17.50 per share

- 2.5 million common stock shares of New Covalto (5 years after closing)

- Rollover of 100% equity:

- PIPE / Financing:

- Anchor Investment (Mandatory Convertible Anchor note)

- Amount: *US$ 60 million (converted from Mexican Pesos)

- Existing notes of $30 million

- Sponsor contributing an additional $30 million

- Interest: 7% p.a. compounded annually

- Payment (at the option of Target): Cash or Kind

- Each of the Mandatorily Convertible Notes is subject to conversion at the Closing into ordinary shares of Target, at a conversion price equal 80% of the lowest price per share paid by investors in business combination

- Amount: *US$ 60 million (converted from Mexican Pesos)

- Anchor Investment (Mandatory Convertible Anchor note)

- Redemption Protections:

- None

- Sponsor Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors & Insiders: 365 days post-closing

- Early-Release from Lockup: If equal to or above $12.50 per share after 7 months from the closing date

- Target Supporting Holders: 180 days post-closing

- SPAC Sponsors & Insiders: 365 days post-closing

- Closing Conditions:

- Regulatory Approvals from:

- The Mexican Anti-Trust Federal Agency

- The Mexican Securities and Banking Commission (“CNBV”) with respect to ultimate beneficial owners and the new indirect shareholders with an ownership interest exceeding 5% after Closing

- Notice to CNBV with respect to new indirect shareholders with an ownership interest exceeding 2%

- Completion of Pre-Closing Capital Restructuring

- Funding of Anchor Investment to Target of an amount in USD equivalent to 600 million Mex$ by September 16, 2022

- Termination Date: May 10, 2023

- No minimum cash condition

- Other customary closing conditions

- Regulatory Approvals from:

- Termination:

- Target Termination fee (Payable to SPAC if Target fails to perform its obligations & covenants).

- It has an option to pay either:

- $5,500,000

- It has an option to pay either:

- OR

- 1,125,251 Target Preference shares of most senior class outstanding at that time

- If no preference shares are outstanding at that time, Target ordinary shares shall be issued

- 1,125,251 Target Preference shares of most senior class outstanding at that time

- Target Termination fee (Payable to SPAC if Target fails to perform its obligations & covenants).

- Additional consideration to Convertible Notes Investors:

- 1,025,000 preference shares of most senior class outstanding at that time

- If no preference shares are outstanding at that time, Target ordinary shares shall be issued

- 1,025,000 preference shares of most senior class outstanding at that time

- Advisors:

- SPAC Financial & Capital Market Advisors: EarlyBirdCapital, Inc.

- SPAC Legal Counsel: Davis Polk & Wardwell LLP

- Target Legal Counsel: Simpson Thacher & Bartlett LLP

- Comparables (N/A):

- No valuations provided

*Denotes estimated figures by CPC

#Reported as on June 30, 2022