November 19, 2022

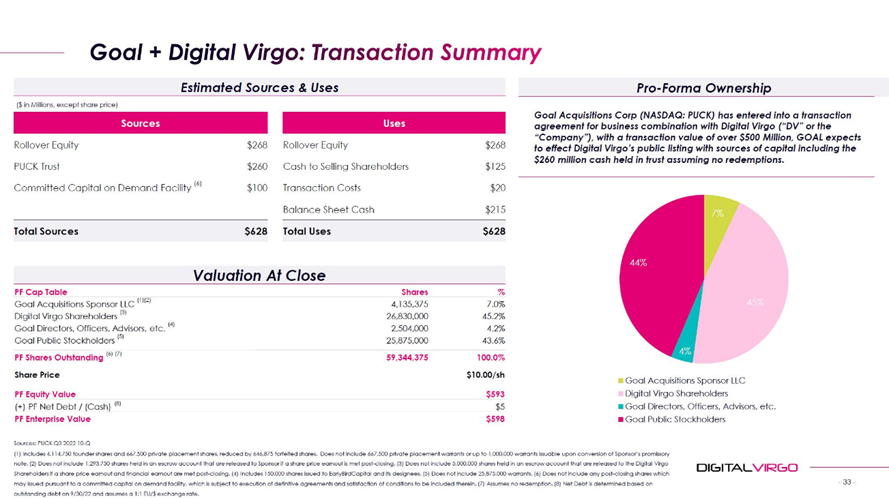

- Global Acquisition Corp. (PUCK) to acquire Digital Virgo (Private) in a transaction valuing the pro forma entity at $598 million in Enterprise Value ($593 million equity value assuming minimum cash condition met).

- Digital Virgo shareholders will receive 26.83 million shares of new shares of common stockas merger consideration along with 5 million earnout shares.

- Sponsor has agreed to forfeit 646,875 founder shares (with potential to recoup 2x via earn-out shares > $15.00).

- Minimum gross cash condition of $20 million.

- Business combination transaction is targeted to close in the first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of common stock + 1 warrant

- #Cash in Trust: $260,034,311 (100.5% of Public Offering)

- Public Shares Outstanding: 25.875 million shares

- Private Shares Outstanding: 6,468,750.00 million shares

- Reported Trust Value/Share: $10.05

- Liquidation Date: February 16, 2023

- Name of Target: Digital Virgo (Private)

- Description of Target: Digital Virgo is one of the world’s leading mobile payment specialists, implementing powerful monetization ecosystems for telecom operators and merchants, serving as a single destination for customers’ mobile content, entertainment, and commerce needs. Digital Virgo deploys global strategies to optimize the payment that consider strategic aspects such as localization, monetization, digital marketing, customer care or regulatory & compliance framework. Digital Virgo’s technological hub made of innovative platforms and tools enables them to respond to their partners’ main challenges of scalability, complexity and security to drive their growth while improving their users’ experience. With more than 2 billion connected users and operating in 40+ countries, Digital Virgo’s global network of local offices allows them to roll out scalable and secure mobile commerce experiences worldwide.

- Announced Date: November 17, 2022

- Expected Close: “First Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1836100/000149315222032717/ex99-1.htm

- Transaction Terms (https://content.bamsec.com/0001493152-22-034948/ex99-1_033.jpg):

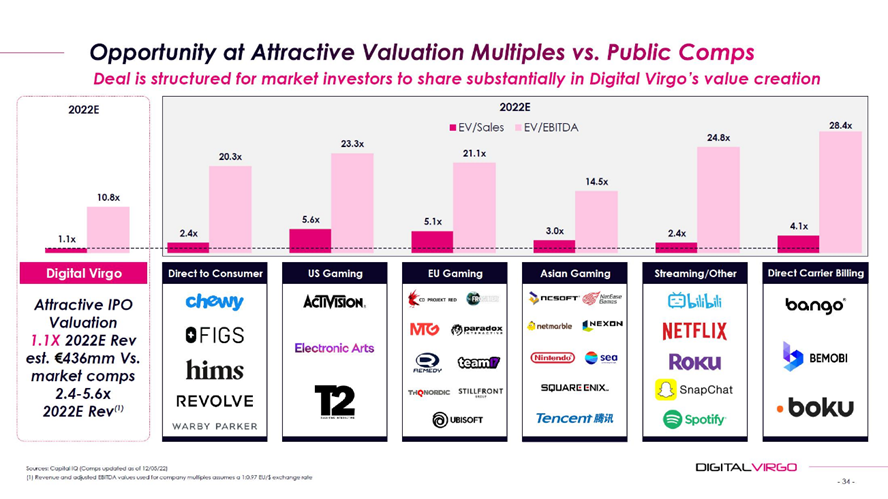

- Diluted Enterprise Value: $598.0 million

- Market Cap Value: $593.0 million (assuming min net cash condition met)

- Target Shareholders Receive:

- 26.83 million new shares of common stock

- Earn-Out: 5 million new shares of common stock

- 2.5 million shares @ $15 per share (end on December 31, 2026)

- 2.5 million shares if SPAC’s EBITDA≥ $60 million (end on December 31, 202

- PIPE / Financing:

- None

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Forfeiture: 646,875 Founder Shares

- Earn-out: Sponsor has the ability to recoup 2x forfeited shares (i.e. 1,293,750 Founder Shares) @ $15 per share (end on December 31, 2026)

- Lock-up:

- Target Security holders: 6 months post-closing

- SPAC Sponsor: Same as IPO, 6 months post-closing

- Closing Conditions:

- Gross Cash Condition: $20 Million

- Execution of definitive agreements for a $100 million committed capital on demand facility

- Delivery a fully executed and binding committed capital on demand facility for at least $100,000,000

- Termination date: February 15, 2023 (subject to a 3-month extension is SEC review or regulatory approval delay)

- Other customary closing conditions

- Termination:

- Termination fee of $2,000,000 to the SPAC

- Other standard termination clauses

- Advisors:

- SPAC Financial Advisors: JMP Securities

- Target Legal Advisors: Winston & Strawn LLP and Peltier Juvigny Marpeau & Associés

- SPAC Legal Advisors: Proskauer Rose LLP

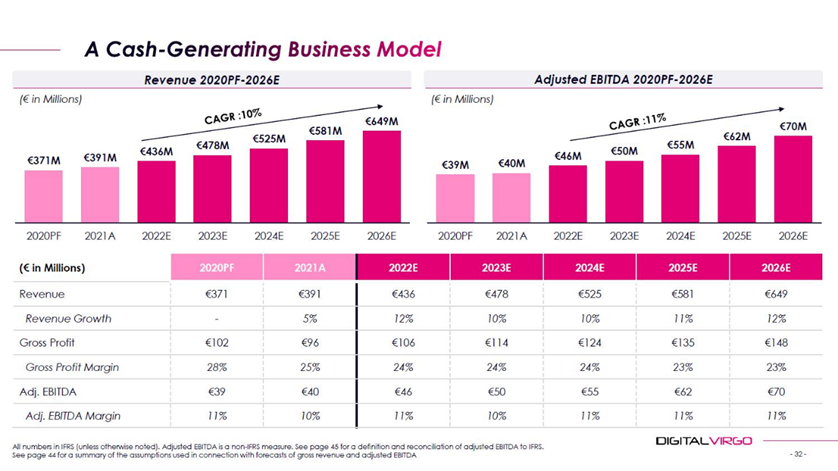

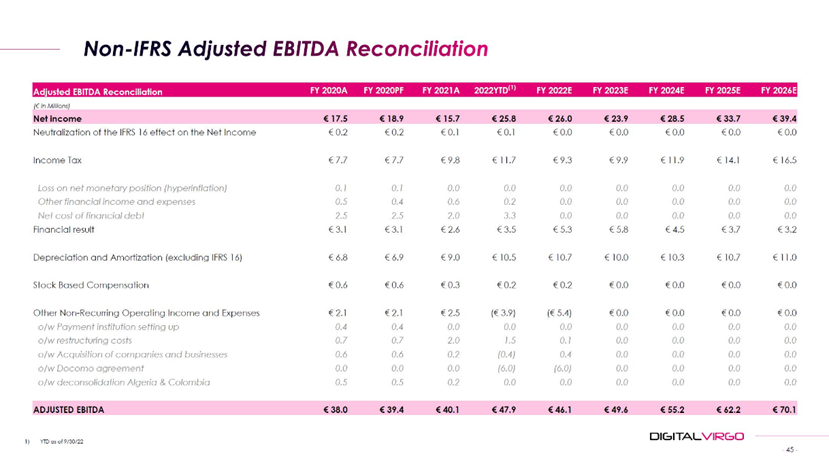

- Financials (https://content.bamsec.com/0001493152-22-034948/ex99-1_032.jpg & https://content.bamsec.com/0001493152-22-034948/ex99-1_045.jpg):

- Management Equity Incentive Plan

- 10.0% of shares outstanding post-closing

- Includes evergreen provision for annual automatic increase

*Denotes estimated figures by CPC

#Reported as on September 30, 2022