October 19, 2022

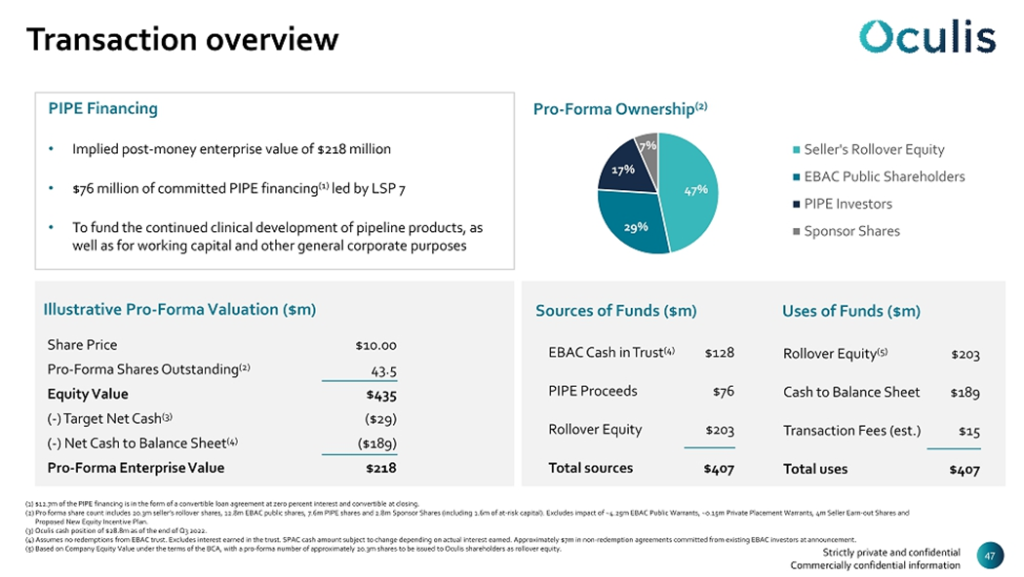

- European Biotech Acquisition Corp. (EBAC) to merge with Oculis, SA (private) in a transaction valuing the pro forma entity at $218 million in Enterprise value ($435 million equity value).

- Oculis shareholders will receive $208 million of merger consideration at $10/share.

- Transaction includes 4 million earnout shares to Oculis shareholders at $15.00, $20.00 and $25.00/share.

- Transaction is supported by $76 million of PIPE financing, $12.7 of which is in the form of convertible loan at 0% interest, convertible at $10/share at closing.

- Sponsor agreed to forfeit 727,096 sponsor shares (22.8%) for no consideration and up to an additional 1,594,348 shares (50%) if gross closing cash is less than $25.5 million (subject to adjustments).

- Minimum net cash condition of $100 million.

- Business combination transaction is targeted to close in first half of 2023.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 0.33 Redeemable Warrant

- #Cash in Trust: $128,317,115 (100.6% of Public Offering)

- Public Shares Outstanding: 12,754,784 Shares

- Private Shares Outstanding: 3,643,792 shares (including 455,096 shares contained in Units)

- Reported Trust Value/Share: $10.06

- Liquidation Date: March 18, 2023

- Name of Target: Oculis, SA

- Description of Target: Oculis is a global biopharmaceutical company purposefully driven to save sight, improve eye care and address medical needs with breakthrough innovations. Oculis’s differentiated pipeline includes candidates for topical retinal treatments, topical biologics and disease modifying treatments. With a presence in key international markets, Oculis is poised to deliver treatments to patients worldwide. Headquartered in Lausanne, Switzerland and with operations in Europe, the U.S. and China, Oculis is led by an experienced management team with an extensive track record and supported by leading international healthcare investors.

- Announced Date: October 17, 2022

- Expected Close: “First Half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1841258/000095010322017851/dp182518_ex9901.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1841258/000095010322017851/image_047.jpg):

- Enterprise Value: $218 million

- Market Capitalization: $435 million

- SPAC Shareholders Receive:

- *12.615 million shares of New Parent at $10/share

- SPAC Sponsor Receive:

- *2.917 million shares of New Parent at $10/share

| Promote | 3,188,696 |

| Shares in Units | 455,096 |

| Total shares | 3,643,792 |

| Forfeited shares | 727,096 |

| Balance (6.71% of 43.5 million shares of New Parent) | 2,916,696 or 2.917 million |

- Target Shareholders Receive:

- Aggregate Merger consideration of $208 million (20.8 million shares of New Parent at $10/share)

- 4 million earnout shares of New Parent (5 years after closing):

- 1.5 million shares @$15.00

- 1.5 million shares @$20.00

- 1 million shares @$25.00

- PIPE / Financing:

- $76 million of committed PIPE financing (led by sponsor):

- $63,303,910 of Common stock PIPE (6,330,391 ordinary shares of SPAC at $10/share)

- $12,670,000 of PIPE is in the form of Convertible loan agreement:

- at zero percent interest

- convertible for New Parent shares at $10 per share on closing

- $76 million of committed PIPE financing (led by sponsor):

- Non-redemption Agreement:

- Certain SPAC Shareholders owning 700,789 SPAC ordinary shares have agreed to not redeem & to vote all of their shares in favor of the transaction proposals

- Sponsor has agreed to transfer 70,079 New Parent shares (10%) in aggregate at closing

- Support Agreement:

- Standard voting support

- At-Risk Sponsor Shares: Sponsor forfeited 727,096 shares (22.8%) of SPAC Class B Common Stock for no consideration

- Additional At-Risk Shares: Sponsor has agreed to forfeit up to an additional 1,594,348 shares (50%) if gross closing cash is less than $25.5 million (after redemption but before transaction expenses)

- Any forfeited shares will be reduced by the number of shares transferred by Sponsor to SPAC shareholders who executed Non-Redemption Agreement

- Provided that, the number of shares transferred to any SPAC shareholder does not exceed 10% of the number of shares owned by such shareholder as of the date of such Non-Redemption Agreement (i.e. a cost no less than $9.09/share)

- Lock-up:

- SPAC Sponsor: 270 days post-closing

- Early Release: If equal to or above $15.00 per share after 180 days from the closing date

- Certain Target shareholders: 180 days post-closing

- Early Release: If equal to or above $15.00 per share after 180 days from the closing date

- SPAC Voting Shareholders (who entered into Non-Redemption Agreement): 90 days post-closing

- SPAC Sponsor: 270 days post-closing

- Closing Conditions:

- Termination date: March 18, 2023

- Minimum Net cash condition of $100 million

- Other customary closing conditions

- Termination:

- Standard termination clauses

- Advisors:

- Target Financial and Capital Market Advisor: BofA Securities and SVB Securities

- SPAC Financial and Capital Advisor: Credit Suisse and Kempen

- Target US Legal Advisors: Cooley (UK) LLP

- SPAC US Legal Advisors: Davis Polk & Wardwell LLP

- Target Swiss Legal Advisors: VISCHER SA

- SPAC Dutch Legal Advisors: Stibbe N.V.

- SPAC Cayman Legal Advisors: Maples Group

- SPAC Placement Agents: Credit Suisse, BofA Securities, SVB Securities, Kempen, and Arctica Finance

- Placement Agents Legal Advisor: Shearman & Sterling LLP

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No Valuations provided

- Equity Incentive Plan:

- Aggregate share reserve = 16% of the New Parent Shares on a fully diluted basis including converted options

*Denotes estimated figures by CPC

#Reported as on September 30, 2022