October 15, 2022

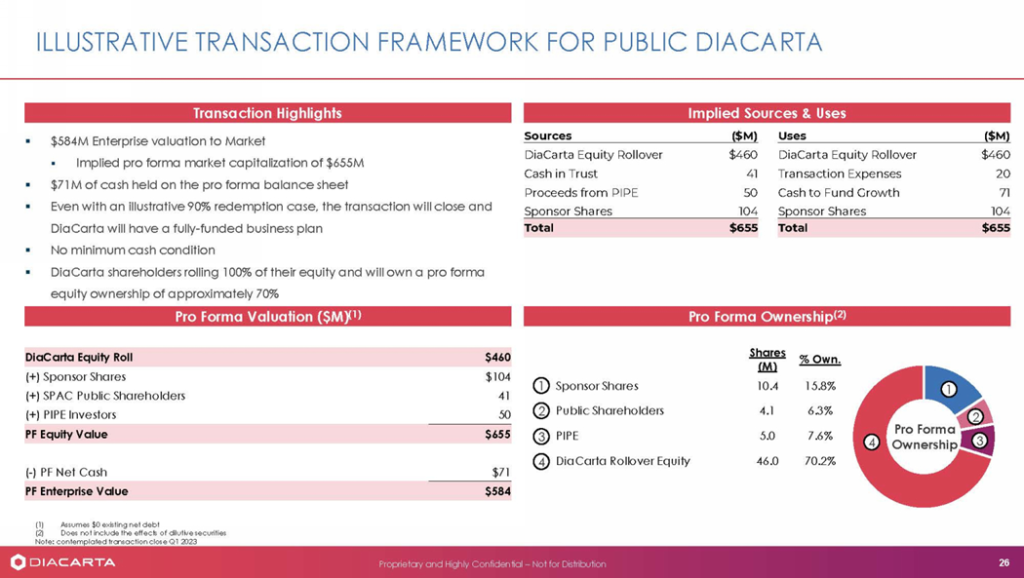

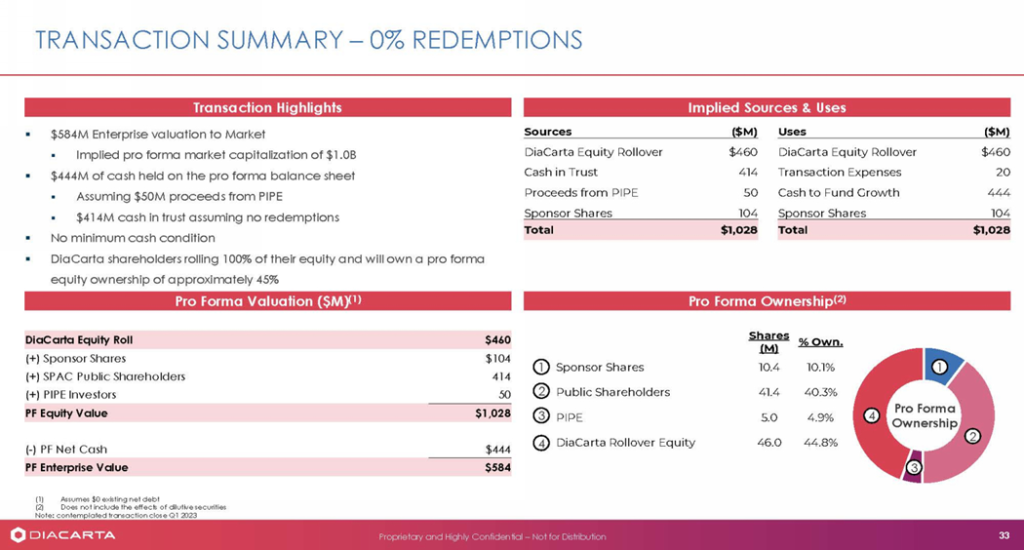

- HH&L Acquisition Co. (HHLA) to acquire DiaCarta (private) in a transaction valuing the pro forma entity at $584 million in enterprise value (Equity value of $655 million at 90% redemptions and $1000 million at 0% redemption) .

- DiaCarta shareholders will receive 46 million common stock shares of HH&L at $10/share.

- HHLA is expected to raise $50 million of Common Stock PIPE at $10/share.

- Sponsor shall forfeit 1,539,300 class B shares if the gross cash available at closing is less than $40 million (subject to adjustments).

- Deferred underwriting fee of $14,490,000 has been waived by the underwriters (Credit Suisse & Goldman Sachs).

- No minimum cash condition.

- Business combination transaction is targeted to close in first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 0.50 Redeemable Warrant

- #Cash in Trust: $416,517,794 (100.6% of Public Offering)

- Public Shares Outstanding: 41.40 million

- Private Shares Outstanding: 10.35 million

- Reported Trust Value/Share: $10.06

- Liquidation Date: February 9, 2023

- Name of Target: DiaCarta

- Description of Target: DiaCarta is a Pleasanton, California-based translational genomics and precision molecular diagnostics company that provides highly sensitive and advanced technologies to improve the way molecular diagnostics and translational genomics impact healthcare treatment plans. DiaCarta’s mission is to improve the well-being of individuals around the world.

- Announced Date: October 14, 2022

- Expected Close: “First Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1824185/000110465922108739/tm2228075d1_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1824185/000110465922108739/tm2228075d1_ex99-2img026.jpg and https://www.sec.gov/Archives/edgar/data/1824185/000110465922108739/tm2228075d1_ex99-2img033.jpg):

- Enterprise Value: $584 million

- Market Capitalization: $655 million (at 90% redemption) and $1,028 million (at 0% redemption)

- Target Shareholders Receive:

- Aggregate Merger Consideration of $460 Million at $10/Share (Pre-Money Equity Valuations)

Figure 1 Transaction Summary-90% redemptions

Figure 2 Transaction Summary-0% Redemption

- PIPE / Financing:

- Expected to raise $50 million of Common Stock PIPE @10/share

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

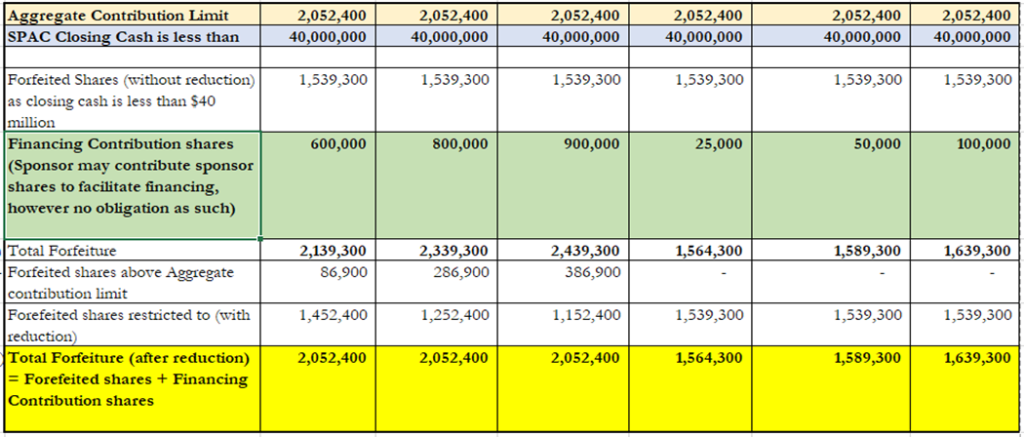

- Sponsor shall forfeit 1,539,300 SPAC Class B Ordinary Shares (Forfeited shares) if:

- SPAC closing cash < $40 million

- If SPAC Closing Cash is equal to or more than $40 million, there shall be no Forfeited Shares

- In addition, Sponsor may elect (no obligation) to forfeit Sponsor Shares to facilitate financing (Financing Contribution Shares):

- If the aggregate number of Forfeited Shares (without reduction) and Financing Contribution Shares exceeds 2,052,400 SPAC Class B Ordinary Shares, then the number of Forfeited Shares shall be reduced to an amount equal to (a) – (b) where

- 2,052,400 SPAC Class B Ordinary Shares

- Financing Contribution Shares actually contributed or forfeited by the Sponsor

Figure 3 *Forfeiture of Sponsor Shares

- Lock-up:

- SPAC Sponsor Holders: 12 months post-closing

- Early Release: If equal to or above $12.00 per share after 6 months from the closing date

- Certain Target shareholders: 12 months post-closing

- Early Release: If equal to or above $12.00 per share after 6 months from the closing date

- SPAC Sponsor Holders: 12 months post-closing

- Closing Conditions:

- Termination date: August 14, 2023 (ten months after the date of the Business Combination Agreement)

- Completion of SPAC domestication & Target Domestication

- No minimum cash condition

- Other customary closing conditions

- Termination:

- Standard termination clauses

- Advisors:

- Target Financial Advisor: Revere Securities LLC

- SPAC Financial Advisor: Cohen & Company Capital Markets (CCM)

- Target Legal Advisors: Loeb & Loeb LLP

- SPAC Legal Advisors: White & Case

- CCM Legal Advisor: Morgan, Lewis & Bockius LLP

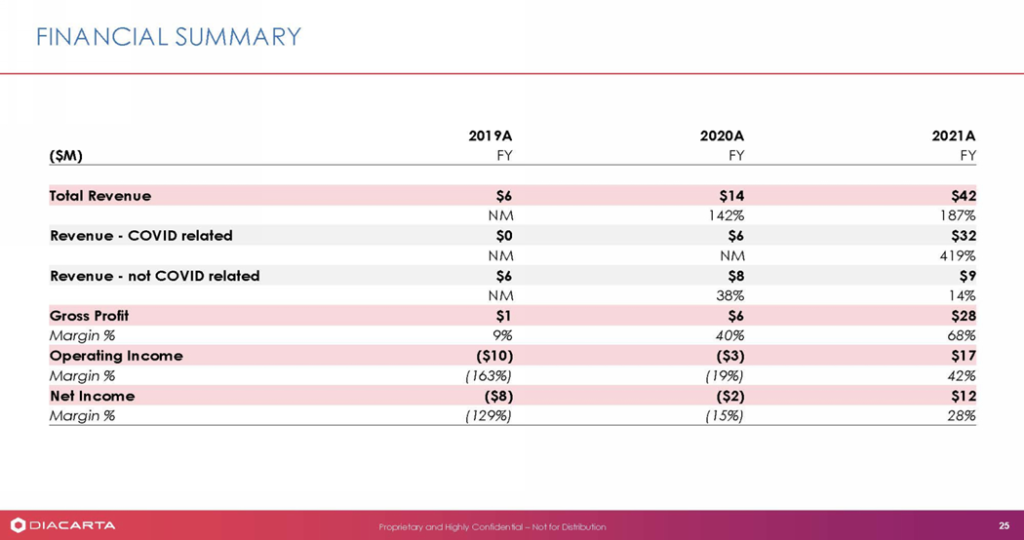

- Financials (https://www.sec.gov/Archives/edgar/data/1824185/000110465922108739/tm2228075d1_ex99-2img025.jpg):

- Comparables (N/A):

- No Valuations provided

- Equity Incentive Plan:

- 15% SPAC shares outstanding on closing shall be reserved

- Automatic annual increase to share reserve of 3% (beginning on the first day of each fiscal year for 10 years after closing)

- Deferred Underwriting fee:

- Goldman Sachs & Credit Suisse have waived their respective portions of $14,490,000 deferred underwriting fee accrued from them for participating as underwriters in SPAC’s IPO, thereby reducing the estimated expenses of the Business Combination by the same amount

*Denotes estimated figures by CPC

#Reported as on September 30, 2022