October 14, 2022

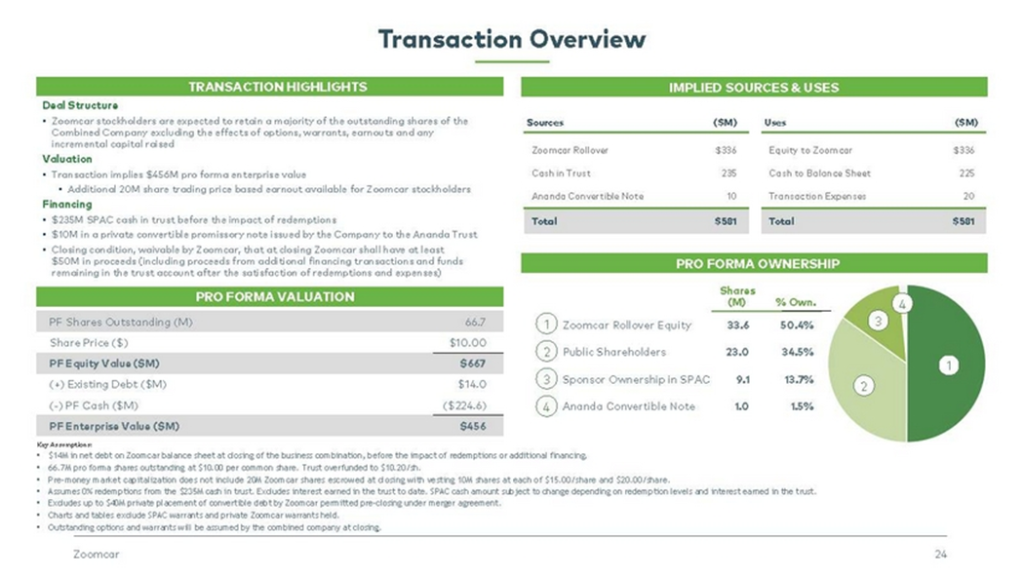

- Innovative International Acquisition Corp. (IOAC) to acquire Zoomcar (private) in a transaction valuing the pro forma entity at $456 million in Enterprise value ($667 million equity value).

- Zoomcar shareholders will receive $336 million of merger consideration at $10/share (subject to adjustments).

- Transaction includes 20 million earnout shares to Zoomcar shareholders at $15.00 and $20.00/share.

- Transaction is supported by $10 million convertible promissory note investment by Ananda Trust at transaction signing. The repayment obligation of the promissory note will be offset against the obligations of Ananda Trust to purchase 1 million shares of Innovative at $10.00/share (Common Stock PIPE).

- Minimum net cash condition of $50 million.

- No termination fees.

- Business combination transaction is targeted to close in the first half of 2023.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.50 Redeemable Warrant

- #Cash in Trust: $236,003,331 (102.6% of Public Offering)

- Public Shares Outstanding: 23,000,000 shares

- Private Shares Outstanding: 8,050,000 shares

- Reported Trust Value/Share: $10.26

- Liquidation Date: January 29, 2023 (extendable if SPAC obtains shareholder approval)

- Name of Target: Zoomcar

- Description of Target: Founded in 2013 and headquartered in Bengaluru, India, Zoomcar is the leading marketplace for car sharing across India, Southeast Asia and the MENA region, with over 25,000 cars currently available to guests using its platform. The Zoomcar community connects vehicle owners with guests, who choose from a selection of cars for use at affordable prices, promoting sustainable, smart transportation solutions in growing markets. Uri Levine, the co-founder of mobility unicorns Waze and Moovit, currently serves as Chairman of Zoomcar’s Board of Directors.

- Announced Date: October 13, 2022

- Expected Close: “first half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1854275/000110465922110031/tm2228439d1_ex99-3.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1854275/000110465922110031/tm2228439d1_ex99-1img025.jpg):

- Enterprise Value: $456 million

- Market Capitalization: $667 million

- Target Shareholders Receive:

- $336 million of equity consideration at $10.00/share (subject to adjustments)

- 20.0 million earnout shares of Innovative Common stock (5-years after closing)

- 10.0 million shares @$15.00/share

- 10.0 million shares @$20.00/share

- In case of change of control during 5-year post-closing earnout period, the shares will be distributed as above if the offer consideration per share in the change of control is equal to or greater than $15.00/share or $20.00/share respectively

- PIPE / Financing:

- $10 million Common stock PIPE at $10/share:

- On failure to consummate transaction, Ananda Trust Note issued by Zoomcar will be exchanged for a Zoomcar convertible promissory note & Subscription Agreement will terminate automatically

- Zoomcar Private financing pre-closing upper limit: $40 million (in the form of debt or equity or convertible securities)

- $10 million Common stock PIPE at $10/share:

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

| SPAC Sponsor PIPE Investor (Ananda Trust) Target Shareholders (Holdings ≥1%) | 6-months post-closing Early Release: If price equals or exceeds $12.00 per share after 150 days of closing |

- Closing Conditions:

- Termination date: January 29, 2023 (extendable if SPAC obtains shareholder approval)

- Completion of Domestication

- Minimum Net cash condition of $50 million

| Cash in Trust | |

| Less: | Redemption Payments |

| Add: | Additional Funding excluding Ananda Trust Investment & Zoomcar Private Financing |

| Less: | Expenses & liabilities at closing |

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clauses

- Advisors:

- Target US Legal Advisors: Ellenoff Grossman & Schole LLP

- SPAC US Legal Advisors: McDermott Will & Emery LLP

- Target Financial Advisor: Cohen & Company Capital Markets

- SPAC Special committee Financial Advisor: Lincoln International

- SPAC Special committee Legal Advisor: Morris, Nichols, Arsht & Tunnell LLP

- Cohen & Company Capital Markets Legal Advisor: DLA Piper LLP (US)

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No Valuations provided

- Equity Incentive Plan:

- 12% of shares outstanding post-closing (on fully diluted basis)

- Annual automatic increase of 3% on January 1 (January 1, 2023 to January 1, 2032)

*Denotes estimated figures by CPC

#Reported as on September 30, 2022