October 5, 2022

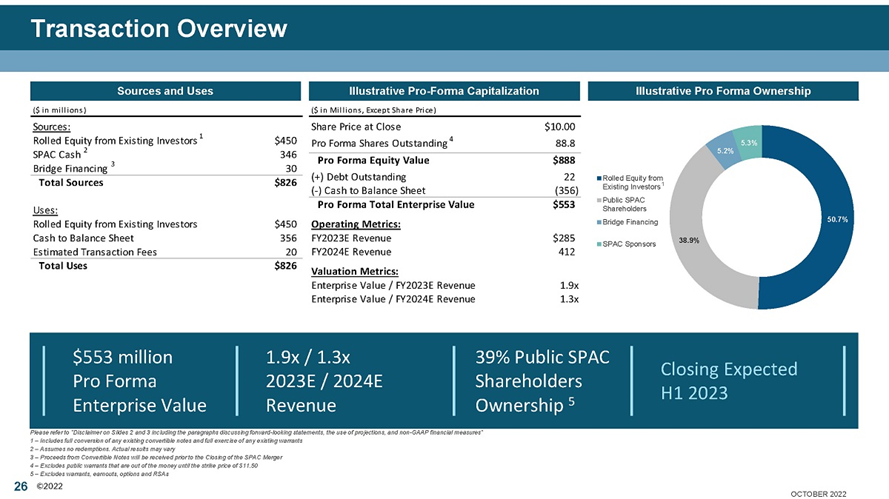

- Freedom Acquisition I Corp. (FACT) to acquire Complete Solaria (Private) in a transaction valuing the combined company at a pro forma enterprise value of $553 million ($888 million of equity value).

- Complete Solaria shareholders will receive $450 million of equity consideration at $10.00/share (subject to adjustments).

- Certain investors have agreed to purchase $7 million convertible notes from Complete Solar and the company is further intending to raise $23 million from additional investors before closing.

- 40% Sponsor shares (*3.45 million shares) will be subject to earnout provision @$20.00 per share (3-years post-closing).

- Sponsors have agreed to assign up to 1.0 million sponsor shares (or *11.59%) to SPAC Shareholder(s) for agreeing to enter into a Non-Redemption Agreement with respect to at least 7.0 million SPAC Class A Shares. If Freedom fails to execute such agreement and closing Cash in Trust < $70 million, then sponsors shall be required to forfeit sponsor shares subject to adjustments.

- Minimum gross cash condition of $100 million.

- The agreement includes bilateral termination fees of $3 million payable under certain circumstances. The defaulting party will be required to pay an additional $1.5 million where termination results from the failure to perform obligations and covenants or where the required shareholder approval was not obtained.

- The business combination is expected to close in the first half of 2023.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 0.25 Redeemable Warrant

- #Cash in Trust: $345,700,519 (100.2% of Public Offering)

- Public Shares Outstanding: 34.50 million

- Private Shares Outstanding: 8.625 million

- Reported Trust Value/Share: $10.02

- Liquidation Date: March 2, 2023

- Name of Target: Complete Solaria

- Target Description: Complete Solaria combines two of the leading residential solar companies in the U.S., Complete Solar and Solaria. The combination of businesses will create a compelling customer offering with best-in-class technology, which is expected to include financing, project fulfilment, and service allowing the combined company to sell more product across more markets and enable a package of financing options for customers wishing to make the switch to a more energy-efficient existence. Complete Solaria is backed by a world- class group of investors, including T.J. Rodgers and certain sponsor shareholders of Freedom.

- Announced Date: October 3, 2022

- Expected Close: “First Half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1838987/000121390022060992/ea166651ex99-1_freedom1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1838987/000121390022061524/ex99-1_026.jpg):

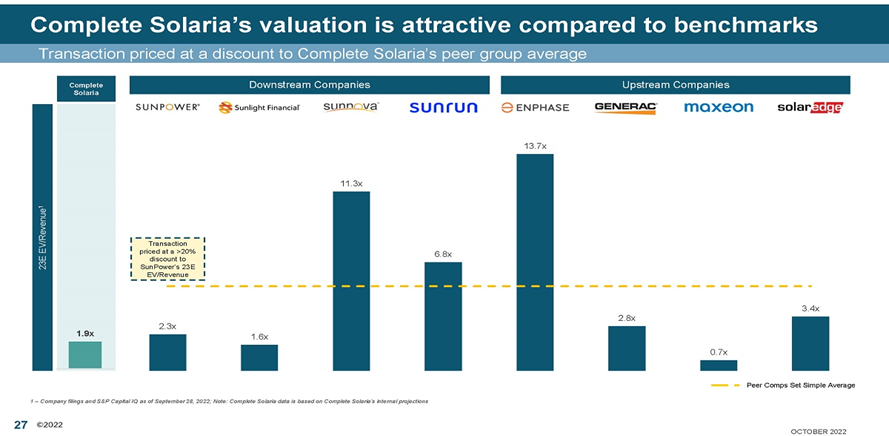

- Enterprise Value: $553 million, 1.9x 2023E Revenue

- Market Cap Value: $888 million

- Target Shareholders Receive (~50.7%):

- $450 million of equity consideration at $10.00/share (subject to adjustments)

- PIPE / Financing:

- Complete Solar:

- Raised $7 million from convertible notes

- Expected to raise up to $23 million in convertible notes before merger

- Complete Solar:

- Redemption Protections:

- Freedom is required to execute SPAC Shareholder Non- Redemption Agreement before closing:

- Non-redeeming shares ≥ 7.0 million Class A Shares (or *20.29%)

- Closing Trust Amount ≥ $70 million

- Freedom is required to execute SPAC Shareholder Non- Redemption Agreement before closing:

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsor and Key Target Shareholders: 12 months post-closing

- Early Release: If equal or above $12 per share after 180 days post-closing

- SPAC Sponsor and Key Target Shareholders: 12 months post-closing

- Closing Conditions:

- Termination date: March 1, 2023 (September 1, 2023 if extended by Freedom)

- Completion of Domestication

- Minimum gross cash condition of $100 million

- Cash includes:

| Cash in trust | |

| Less: | Redemptions |

| Add: | Convertible Note Financing received by Complete Solar |

| Add: | Additional financing received by Freedom (consented by Complete Solar) |

| Add: | PIPE (received at least 30 days before closing) |

| Less: | Freedom transaction expenses in excess of $20 million |

- Consummation of required transaction as per Required Transaction Merger Agreement

- Other customary closing conditions

- Termination:

- Required Transaction not consummated by November 2, 2023 (within 30 days following date of BCA)

- Non-receipt of fairness opinion by Freedom Board/Special Committee by November 2, 2023

- Complete Solar’s non-issuance of $10 million (minimum) convertible notes by January 16, 2023

- Other standard termination clauses

| Termination fee payable to Freedom if: | Termination fee payable to Complete Solar if: | Amount of Payment |

| (a) There is a breach of representations & warranties, covenants, obligations etc. (b) Required shareholder approval not obtained (c) Acquisition proposal made for Complete Solar not withdrawn before termination (d) Complete Solar executes/completes an alternative transaction within 12 months of termination | (a) There is a breach of representations & warranties, covenants, obligations etc. (b) Required shareholder approval not obtained (c) Change of recommendation w.r.t Business Combination (d) Freedom executes/completes an alternative transaction within 12 months of termination | $3.00 million |

| Additional payment if the agreement is terminated due to reasons mentioned in (a) or (b) above | $1.50 million | |

- Advisors:

- SPAC BOD Advisor (Fairness Opinion): Duff and Phelps

- Target Legal Advisors: Cooley

- SPAC Legal Advisors: Paul Hastings LLP

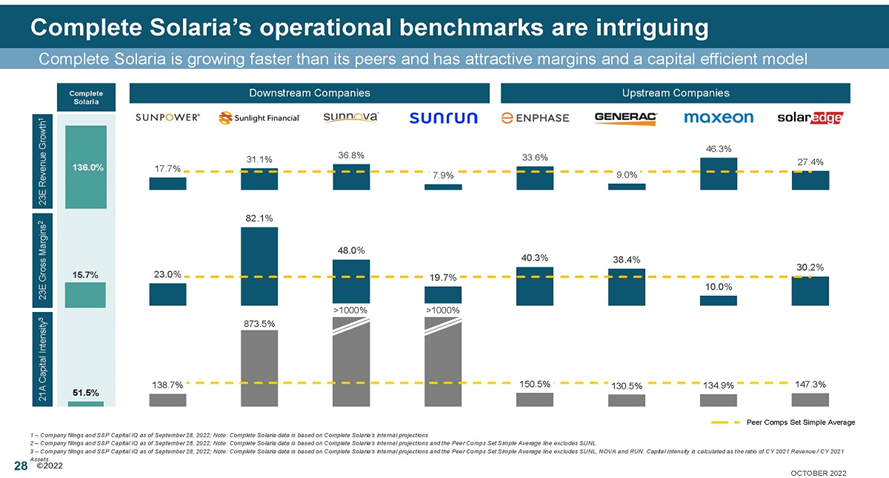

- Comparables (https://www.sec.gov/Archives/edgar/data/1838987/000121390022061524/ex99-1_027.jpg and https://www.sec.gov/Archives/edgar/data/1838987/000121390022061524/ex99-1_028.jpg):

- Equity Incentive Plan:

- Initial share pool reserve = 10% of common stock outstanding post-closing

- Includes an evergreen provision resulting in an automatic increase of 2%

*Denotes estimated figures by CPC

#Reported as on June 30, 2022