October 20, 2022

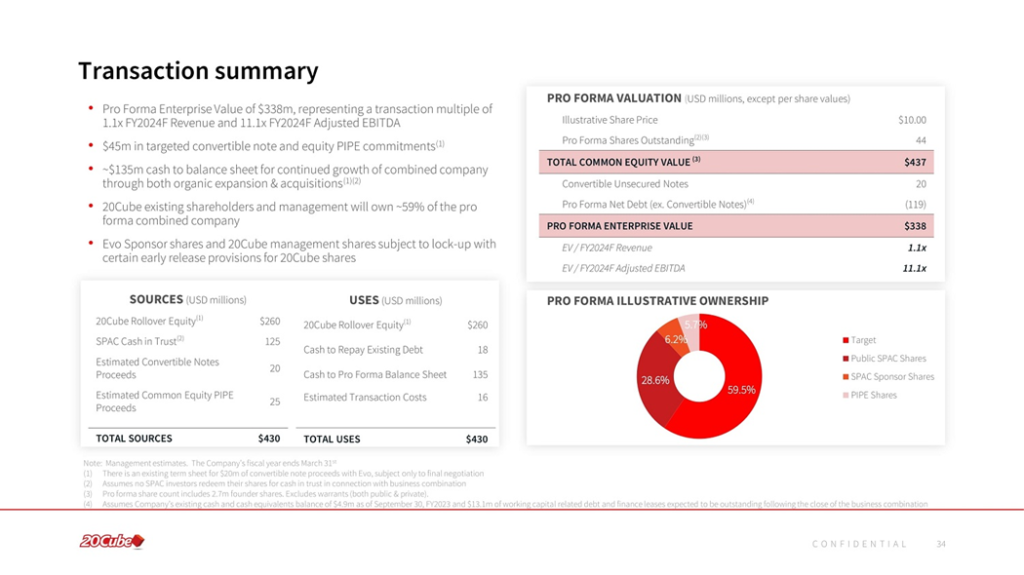

- Evo Acquisition Corporation (EVOJ) to merge with 20Cube Logistics (private) in a transaction valuing the pro forma entity at $338 million in Enterprise value ($437 million equity value).

- 20Cube shareholders will receive $260 million of aggregate merger consideration.

- Transaction is expected to be supported by $45 million, $20 million from Convertible Notes and $25 million from Common Equity PIPE.

- Sponsor will forfeit certain founder shares after closing under certain circumstances.

- Minimum gross cash condition of $45 million including at least $25 million from Non-convertible PIPE or Trust account funds post redemption.

- No termination fees.

- Business combination transaction is targeted to close in the first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 0.50 Redeemable Warrant

- #Cash in Trust: $125,801,792 (100.6% of Public Offering)

- Public Shares Outstanding: 12,500,500 shares

- Private Shares Outstanding: 3,125,125 shares

- Reported Trust Value/Share: $10.06

- Liquidation Date: February 11, 2023

- Name of Target: 20Cube Logistics

- Description of Target: 20Cube is a software-enabled international supply chain orchestrator from purchase order (PO) to point of delivery (POD) with a technology-driven, proven proprietary system and key presence at over 60 locations in Asia, Australia and East Africa. 20 Cube has over 600 employees. 20Cube was built from the ground up over the past 10 years on a disruptive software, workflow and control tower driven platform. 20Cube’s platform is centered around MyHubPlus, which captures data from every part of the supply chain to provide customers with unprecedented real-time visibility, alerts, exception management and reporting. Its suite of freight forwarding, intelligent warehousing/distribution, customs and trade compliance solutions have resulted in significant savings from better container utilization, load balancing, predictability, and logistics process management.

- Announced Date: October 18, 2022

- Expected Close: “first Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1834342/000121390022064742/ea167272ex99-1_evoacquist.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1834342/000121390022064829/ex99-1_034.jpg):

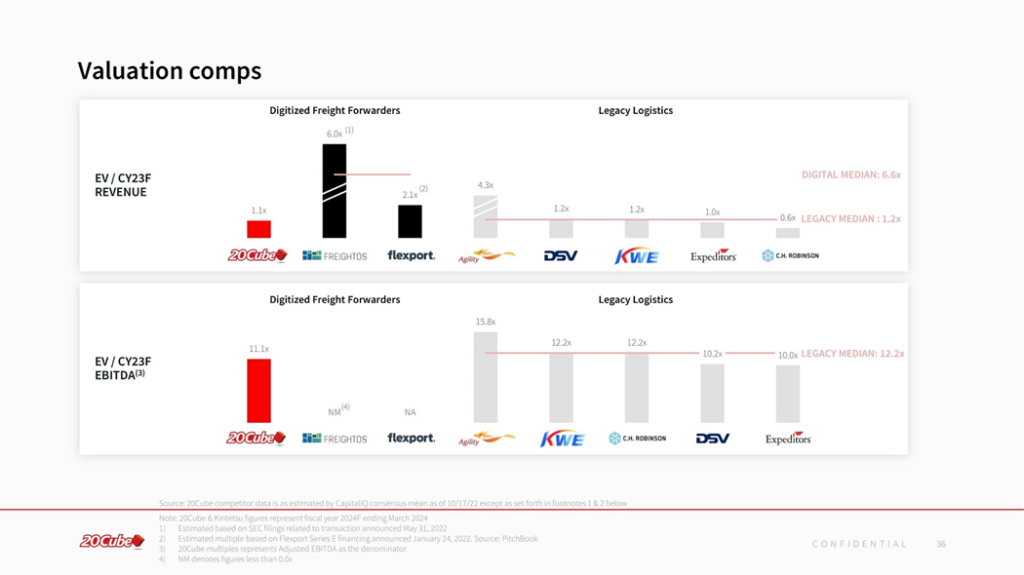

- Enterprise Value: $338 million, 11.1x 2024E Adjusted EBITDA

- Market Capitalization: $437 million

- SPAC shareholders:

- 1 Pubco ordinary share in exchange for each SPAC Common stock outstanding at closing

- 1 Pubco Warrant in exchange for each SPAC Warrant outstanding at closing

- Target Shareholders Receive (~59% in combined company assuming no redemptions):

- $260 million of aggregate consideration (aggregate of Pubco Ordinary Shares & Assumed Options)

- PIPE / Financing:

- $20 million of subordinated convertible Note (this investment is subject to final negotiation of terms & execution of definitive documents)

- Expected to raise $25 million in common equity PIPE

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Sponsor will forfeit certain of its founder shares under certain circumstances

- Lock-up:

- Signing Sellers (Target shareholders): 1-year post-closing

- Early Release: If price equals or exceeds $12.00 per share after 150 days of closing

- Signing Sellers (Target shareholders): 1-year post-closing

| Holder | Pubco Ordinary shares | Lock-Up Provision |

| Mahesh Niruttan | 200,000 | Exempt from Lock-Up restrictions for satisfying tax obligations |

| Anand Seetharamam | 100,000 | |

| Zephyr Peacock India Fund III | 600,000 | |

| Zephyr Peacock India Fund III | Lock-Up Release: With respect to ^50% Pubco Ordinary shares: 3 months post-closing With respect to ^100% Pubco Ordinary shares: 6 months post-closing ^ includes the shares exempted for satisfying tax obligations | |

| Zephyr Peacock India Fund Limited | ||

| Credence Capital Fund II (Cayman) Limited | ||

- Closing Conditions:

- Termination date: February 8, 2023 (or May 8, 2023 or last date for SPAC to consummate its business combination pursuant extension, whichever comes first)

- Pubco qualifying as Foreign Private Issuer

- Minimum gross cash condition of $45 million (minimum $25 million of which shall be from Trust Account after redemptions OR Non-convertible PIPE financing)

- Receipt of repayment evidence of outstanding loans from Twenty-Eight Dragons Private Limited & release of related liens and collateral

- PCAOB financials by November 30, 2022

- Other customary closing conditions

- Termination:

- PIPE financing entered by SPAC and Pubco in binding equity security commitments on or before December 31, 2022 is less than $25 million (this termination right expires after commitments are obtained)

- No termination fees

- Other standard termination clauses

- Advisors:

- SPAC Financial Advisor & Lead Placement Agent: B. Riley Securities

- Target Financial Advisors: Drake Star Partners

- SPAC Legal Advisors: Ellenoff Grossman & Schole LLP

- Target Legal Advisors: Foley & Lardner LLP

- Placement Agent counsel: Kirkland & Ellis LLP

- Equity Incentive Plan

- 5% of aggregate number of Pubco Ordinary Shares issued & outstanding post-closing

*Denotes estimated figures by CPC

#Reported as on September 30, 2022